- Bullish news appears to be mounting for copper prices.

- China’s surprise pivot away from its zero-Covid policies have helped lift copper prices higher.

- Most projections expect a copper surplus for the year, but the market is especially volatile, so who knows what might happen?

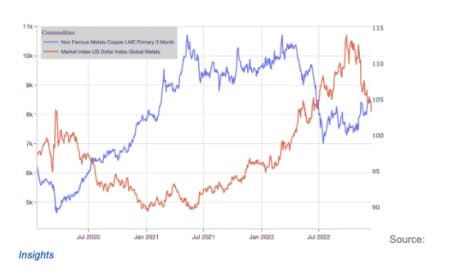

The Copper Monthly Metals Index (MMI) rose 3.87% from November to December. As with other base metals, copper prices broke out of range to the upside last month as China began to pivot away from zero-COVID. Copper prices rallied to a peak on November 11 before a brief and modest retracement. Shortly after that, prices resumed their ascent. By December 8, copper prices had established a new higher high.

CPI Data Sparks Optimism, Fed Slows Rate Hikes

According to the Bureau of Labor Statistics, the November Consumer Price Index (CPI) rose 7.1% year over year. This marked the lowest reading since December 2021 and the second consecutive month of decline after inflation moderated to 7.7% in October. The data beat market expectations and allowed the Federal Reserve to take its foot off the gas. Following four consecutive months of 75 basis point rate hikes, the Fed issued a 50 basis point rate hike at its mid-December meeting.

The move raised benchmark interest rates to their highest levels in 15 years. It also accompanied indications the Fed would continue to raise and sustain such rates until 2024. That said, the moderated approach came as a promising sign to markets. Between the optimistic CPI data and the Fed’s slowed pace, the U.S. dollar index (DXY) slid to its lowest point since June.

An increasingly soft U.S. dollar has added enough support for both copper prices and base metals to see prices reverse last month. Indeed, copper broke out of three months of consolidation to see its first month-over-month increase since March. Between November and December, prices rose 10.25%.

[Exclusive: Biden To Introduce “Biden Bucks”?]

This included an additional 3.01% increase during the first two weeks of December. The continued moves to the downside for the U.S. dollar index look increasingly like a reversal. This seems particularly evident considering the index peaked at a 20-year high in late September.

Copper Prices: Turmoil in Peru Poses Supply-Side Risk

Peru declared a state of emergency emergence after deadly protests erupted following the impeachment and arrest of its former president. Leftist Pedro Castillo was quickly stripped of his office after attempting to dissolve Peru’s congress and replace it with an “exceptional emergency government.” Prior to the move, Castillo faced an early December impeachment vote over allegations of corruption. However, it appeared unlikely he would have lost despite his drastic attempt to fend it off.

Vice President Dina Boluarte quickly replaced Castillo, becoming Peru’s sixth president in five years. Her ascendance to the office resulted in intense protests throughout the country. The governments of Mexico, Argentina, Bolivia, and Columbia issued statements in support of Castillo and continued to refer to him as the “President.” In a bid to calm the political upheaval, Boularte called for moving up the next general election to April of 2024.

Short Term Expectation

In the short term, protests pose a substantial supply-side risk to copper. Should they continue, they could further boost already-bullish copper prices. Already, several roadblocks have delayed and cut off shipments to and from mines. Most recently, Freeport McMoRan’s Cerro Verde mine, located near the city of Arequipa, noted logistics setbacks for workers, supplies, and products due to protests.

Near Cusco, protesters blocked off a key mining corridor for the Las Bambas mine. Peru is the second-largest global copper producer after Chile. Prior to the latest political turmoil, mines throughout the country faced repeated disruptions from protesters angling for further financial support from mining companies.

For as long as she can remain in office, Boularte may prove a moderating force. Like her predecessor, Boluarte ran under Free Peru, known in Peru as a Marxist political party. However, in a January 2022 interview, she stated she did not embrace the party’s ideology. Indeed, her early cabinet appointments included Alex Conteras as the economy minister, who is known for a pro-market stance. So far, she has yet to announce her political agenda, especially concerning Peru’s mining industry.

However, her early decisions appear less radical than Castillo’s. Therefore, they will perhaps pose less of an upside risk to copper prices. Castillo’s administration was marked by repeated attempts to tax and regulate the mining industry, including by implementing a since-rejected new constitution.

The Unknowns of Copper Prices in 2023

Copper prices managed to break out of the directional uncertainty that plagued them throughout the fall. Still, the unknowns of 2023 could once again shift price direction.

In the short term, China’s unraveling of zero-COVID poses a volatility risk. Indeed, much of the recent upside price action has been speculative about the return of Chinese demand. But as of yet, demand has not shown signs of meaningful recovery. Furthermore, rising infection rates continue to disrupt consumer spending and manufacturing.

The extent to which China’s economy will recover in the long term also remains a looming uncertainty. It’s estimated that China will grapple with the cost of its roughly three-year-long economically restrictive approach to the virus for years. That’s on top of ongoing declines within its property sector, aging population, and high debt levels.

In the West, opinions remain split on the depth and length of a downturn in the U.S. while the Fed slowed the pace of its quantitative tightening efforts, it remains steadfast about the need to continue and sustain high interest rates. Invariably, this will mean a drag on the U.S. economy into the new year, which up to this point has proved resilient.

Between the U.S. and China, 2023 copper demand remains a question mark. Most projections expect a copper surplus for the year. An oversupply would add downside pressure to prices and risk stalling the current bull market. This means copper prices could quickly invert downward should market expectations on Chinese or U.S. demand prove overly optimistic.

By Nichole Bastin

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Leave a Reply