There are a million reasons to own precious metals as a hedge right now: bank collapses, inflation, bond risk, recession, dollar devaluation, geopolitical tensions, etc.

It’s hard to come up with a single reason not to have at least some precious metals as protection today.

But for many investors, basic wealth protection is not enough — they want to profit. And when looking at the current state of the precious metals market, the best place to look for profit is in silver.

Silver is often called the “poor man's gold” because it offers similar benefits as gold but at a lower cost. This makes it an attractive option for investors who want to invest in precious metals but don't have the budget for gold.

But the big attraction to silver is its price volatility.

Simply put, silver prices swing more intensely than gold. That means there is more potential for higher returns over a shorter period.

Of course, that also means more potential for bigger losses. Nevertheless, silver has been a valuable commodity for thousands of years, and its value has only increased over time.

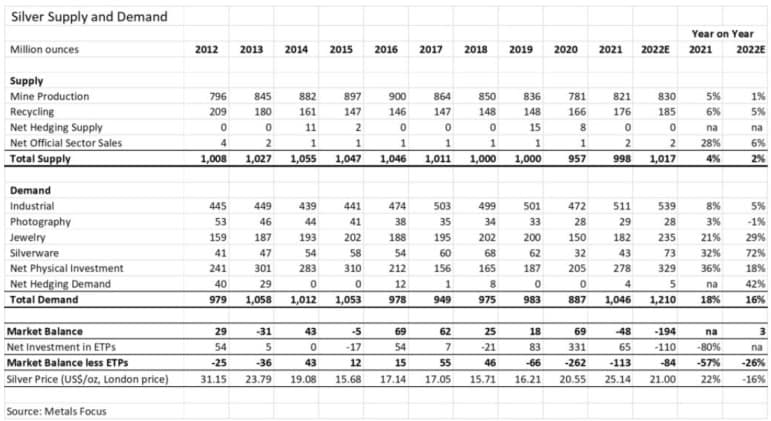

With the global demand for silver on the rise, now is the perfect time to invest in the white metal. Although the 2022 data has not been totally compiled just yet, the Silver Institute says, “Global silver demand is expected to reach a new high of 1.21 billion ounces in 2022, up by 16% from 2021. Each key segment of demand, except photography, is set to post a new peak.”

[Exclusive: Biden To Introduce “Biden Bucks”?]

When it comes to investing in silver, the two most popular vehicles are physical bullion (coins and bars) and stocks.

However, there are two big downsides that make investing in physical silver a pain, and those are storage and liquidity.

Storage and liquidity are also downsides to owning physical gold bullion, but for silver those downsides are intensified.

Currently priced at about $23 an ounce, silver is a much cheaper metal. That means you can buy a lot of it. A $10,000 investment buys 27 pounds of silver — and let me tell you that 27 pounds doesn’t sound too bad on paper, but moving, storing, and selling 27 pounds of solid metal is no cakewalk. It’s a lot of time, effort, and money.

Then on top of that you need to find someone ready to buy 27 pounds of your solid metal when it comes time to divest.

Compare that with owning physical gold. A $10,000 physical gold investment amounts to a little over 5 ounces. You could keep that in your pocket.

I do think investors should own some physical gold bullion, but when it comes to investing in silver, stocks are simply a much better way to get in on the action.

Many silver mining companies have seen significant growth in recent years, with stock prices increasing by as much as 300%. With silver prices projected to continue rising, there is plenty of potential for further growth and profitability.

Moreover, some silver mining companies pay dividends to their shareholders, which can provide a source of passive income for investors. Physical silver bullion does not offer this benefit.

So if you're considering investing in precious metals, owning a bit of gold bullion is a good idea, but if you want to invest in silver to leverage the market, your best bet is with silver stocks.

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Until next time,

Luke Burgess

Leave a Reply