In this Article: Central Banks Are Buying More GoldWhy Didn’t the Gold Price Rise Higher After Increased DemandWhy You Should Buy Gold Now Every week, we receive fantastic questions from your fellow readers. And recently, many of you have written in about gold. Here are some of the excellent points you raised: "I just saw your gold piece from Melbourne, Australia. … [Read more...] about 3 Reasons Why Now is the Time to Buy Gold

Price Volatility a Big Attraction for Silver Investors

There are a million reasons to own precious metals as a hedge right now: bank collapses, inflation, bond risk, recession, dollar devaluation, geopolitical tensions, etc. It’s hard to come up with a single reason not to have at least some precious metals as protection today. But for many investors, basic wealth protection is not enough — they want to profit. And … [Read more...] about Price Volatility a Big Attraction for Silver Investors

When Will Gold Price Rise in 2023?

In this Article: 2022 started off strong for gold...A major bull market of the U.S. dollar...If these predictions are accurate... 2022 taught gold investors a very important lesson: The value of the U.S. dollar influences gold prices much more than inflation data. In fact, gold pretty much ignored rising U.S. inflation in 2022, despite prices increasing at … [Read more...] about When Will Gold Price Rise in 2023?

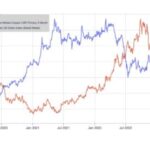

Will the Copper Bull Market Continue Through 2023?

Bullish news appears to be mounting for copper prices.China’s surprise pivot away from its zero-Covid policies have helped lift copper prices higher.Most projections expect a copper surplus for the year, but the market is especially volatile, so who knows what might happen? The Copper Monthly Metals Index (MMI) rose 3.87% from November to December. As with other … [Read more...] about Will the Copper Bull Market Continue Through 2023?

Investing in Physical Gold has an Overlooked Upside

In this Article: A secret and powerful benefit...Selling physical gold and silver bullion is more involvedA personal example... Investing in physical gold and silver bullion holds a secret and powerful benefit… one that both creates a hedge and builds a foundation for wealth accumulation. But I’ll tell you now that it’s not an equal benefit. It’s something that … [Read more...] about Investing in Physical Gold has an Overlooked Upside