In this Article:

- 2022 started off strong for gold…

- A major bull market of the U.S. dollar…

- If these predictions are accurate…

2022 taught gold investors a very important lesson: The value of the U.S. dollar influences gold prices much more than inflation data.

In fact, gold pretty much ignored rising U.S. inflation in 2022, despite prices increasing at their fastest levels in four decades.

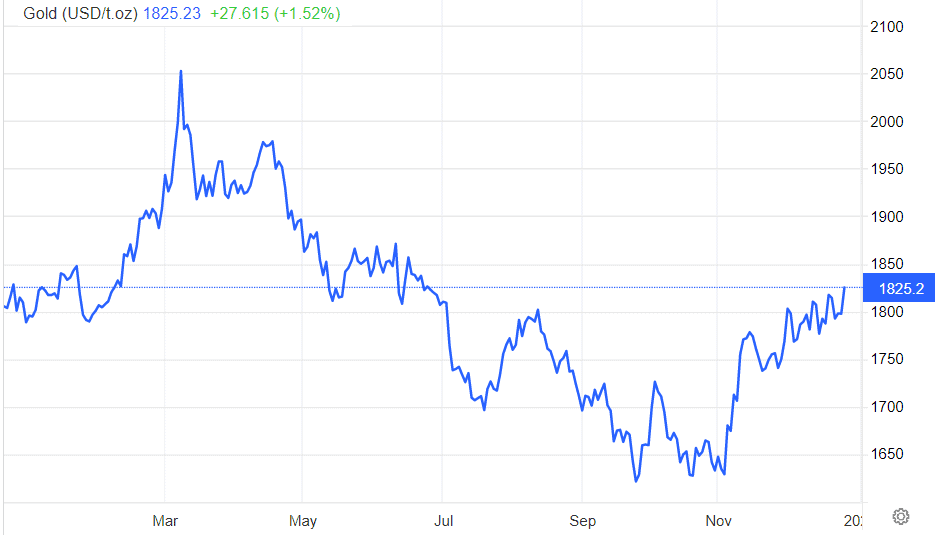

The beginning of 2022 started off strong for gold.

Driven by a general rally in commodity prices stemming from geopolitical conflict between Russia and Ukraine, gold prices blew past $2,000 an ounce in the first quarter of the year.

And with inflation rapidly rising in America, many investors expected the rally in gold to continue. But that’s not what happened.

Despite annual inflation rising to a 40-year high — topping out at 9.1% in July — gold prices declined through November.

Gold Prices — One Year

It’s traditionally believed that gold prices will always increase along with inflation of prices for things like food and energy. But 2022 showed gold investors that the value of the U.S. dollar is way more important to gold than current inflation data.

Of course, there were multiple factors that contributed to gold’s price decline in 2022. But the primary factor was the Federal Reserve’s response to rising inflation and, more importantly, a subsequent rally in the U.S. dollar.

The initial response to inflation was to downplay increasing prices. Earlier this year, both the Federal Reserve and Biden administration tried to sell the public on the idea that elevated inflation levels were “transitory.”

[Exclusive: Biden To Introduce “Biden Bucks”?]

But by May the Fed flip-flopped on that message with the largest interest rate hike since 1994.

The Fed continued with aggressive rate hikes through the end of the year, taking the federal funds rate from 0.25%–0.50% in March to 3.75%–4.00% in November.

These rate hikes triggered a major bull market of the U.S. dollar, taking its value to 20-year highs. As measured by the U.S. Dollar Index, the greenback increased almost 20% between January and September.

U.S. Dollar Index — 25 Years

Other factors propping up the U.S. dollar — and inversely weighing on gold prices — include weakness in foreign currencies throughout the year, particularly the euro, British pound, Swiss franc, and Japanese yen.

In short 2022 was an incredible year for the U.S. dollar, which gold prices very much inversely followed. And looking ahead to 2023, I think we can expect gold prices to continue inversely following the dollar.

Many economists are predicting either strength or sideways action in the USD through the middle of next year as foreign central banks deal with their own inflation issues.

But after that, analysts are expecting the dollar to decline in the face of a U.S. recession.

[Jim Rickards: How to Ride “The C-Day Switchover” For Big Profits]

Wells Fargo, for one, said in its 2023 outlook:

The greenback can experience a bout of renewed strength into early 2023. With the Fed likely to deliver more hikes than markets are priced for, a hawkish Fed should support the greenback. We believe the Fed is likely to deliver more interest rate hikes than financial markets are priced for, and indeed more tightening than many other central banks… Starting in the middle of next year, we believe growth differentials between the United States and major foreign economies should start to favor international G-10 countries, and these growth dynamics should be a contributing force to a sustained dollar depreciation. We expect the United States to enter recession only during the second half of next year.

If these predictions are accurate we should expect gold prices to remain mostly flat or lower in the first quarter. But after that we should expect to see prices for the yellow metal trend higher.

I believe seasonal demand will continue to keep gold prices above $1,800 an ounce through February before a brief sell-off period in March/April. After that, however, I think we’ll see gold easily reclaim the $2,000 level and move higher from there.

How much higher will depend on the dollar. But it also depends on hype and speculation.

$2,000 an ounce is a very important psychological level for gold. The yellow metal has topped the $2,000 level a few times. But it has always failed to stay over $2,000 an ounce for more than a few days. If gold prices sat above $2,000 for a few weeks, speculation on even higher prices would be more than likely. And that speculation could easily turn into hype, taking gold prices to ridiculous levels.

I mean, just consider that Bitcoin was valued at almost $69,000 per BTC at one point. An NFT sold for $91.8 million! If the value of these alternative “assets” can soar so much, gold prices can too.

At the end of the day, we are bullish to very bullish on gold prices for the upcoming year.

Until next time,

Luke Burgess

Editor, Junior Mining Trader

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Leave a Reply