In this Article:

Precious metal prices are rising amid seasonal demand and a devaluation of the U.S. dollar.

In the past three weeks alone, gold prices have increased by as much as $150 an ounce.

Meanwhile, the price of COMEX silver jumped almost 15%.

One Month Gold Prices

One Month Silver Prices

We talked about the reasons for the dollar’s reversal and the factors driving seasonal gold demand last week.

Today I want to show you three gold and silver stocks trading under $5 that are best positioned to leverage rising metal prices.

The first is a well-known Canadian gold producer with a long-standing proven track record for delivering shareholder gains.

Kinross Gold (NYSE: KGC)

[Exclusive: Biden To Introduce “Biden Bucks”?]

Kinross produces about 2 million ounces of gold per year from six mines on three continents. The company’s biggest assets include the Paracatu mine in Brazil and Tasiast mine in northwestern Mauritania.

Paracatu is the largest gold mine in Brazil, producing more than 550,000 ounces of gold per year. Meanwhile, Kinross is rapidly developing its Tasiast mine into another world-class project by increasing throughput year after year.

The company also operates the Fort Knox mine near Fairbanks, Alaska (which produces more than 250,000 ounces of gold per annum) and is actively developing large gold projects in North and South America.

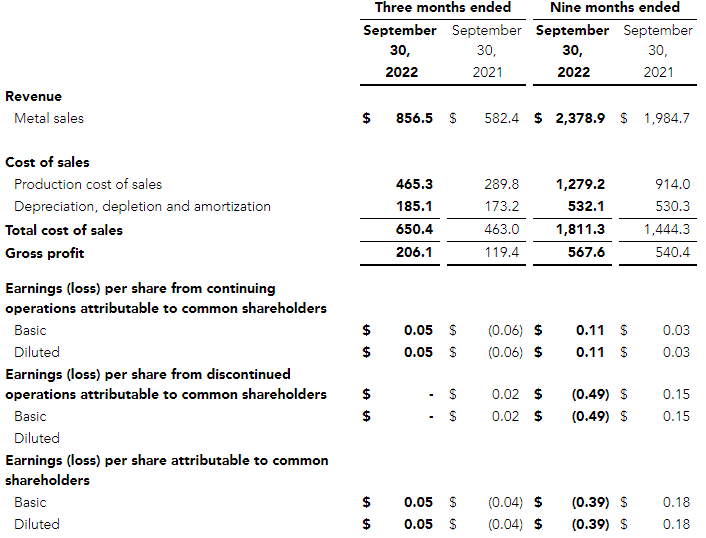

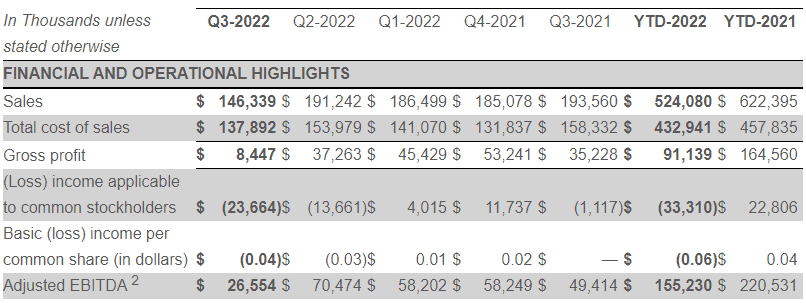

Kinross has a strong balance sheet, with sales, earnings, total assets, and production all increasing in the most recent quarter.

Kinross Gold 3Q 2022 Financial Summary

Even though shares of KGC are trading at just about $4 right now, the company has a market cap of $5.2 billion, making it the largest precious metal company we’ll talk about today. However, strong financials and great name recognition make KGC a fairly safe bet to leverage rising gold prices.

It should also be noted that KGC pays a little dividend at just over 2.9% right now. The next ex-dividend date is December 1. Investors who own shares before that date will receive $0.03 per share on December 15. That’s not going to buy you a Ferrari. But it’s something extra for the holidays.

Up next is another well-known Canadian gold miner: Yamana Gold.

[Alert: Biden issues Executive Order #14067]

Yamana Gold (NYSE: AUY)

Yamana Gold is actually quite similar to Kinross in a lot of ways. The company operates five precious metal mines and has a significant pipeline of development projects in North and South America.

The company produces about a million gold-equivalent ounces per year; about 88% of that is gold, the rest is silver. One of Yamana’s most important assets is the Malartic mine in Quebec.

The company owns a 50% stake in the Malartic mine (along with Agnico Eagle Mines), which is Canada’s largest gold mine, producing more than 300,000 ounces of gold per year. The Malartic mine is currently transitioning from a large open-pit operation to an underground mine. Yamana says the move could nearly double gold production, adding as much as 600,000 ounces, when completed.

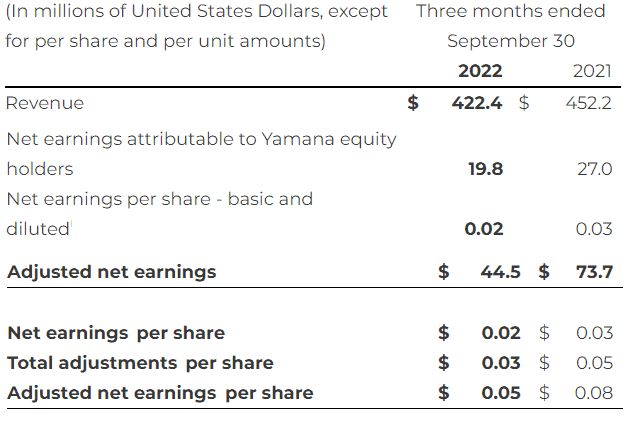

Unlike Kinross, however, Yamana’s financials could be better. Revenue, earnings, cash flow, and production all decreased in the third quarter of 2022 compared with 3Q 2021.

Yamana Gold 3Q 2022 Financial Summary

Yamana just barely makes this list for gold stocks under $5. As I’m writing this, shares are closed at $4.98. That gives the company about a $4.8 billion market cap. Comparing Kinross’ P/E ratio (16.72) to Yamana’s (18.44), Kinross looks a little cheaper right now. However, both companies have very good name recognition and should do well as commodity prices continue to rise.

[Alert: Biden To Introduce Social Credit System Like China?]

Moving on to a company that focuses on silver, there’s Hecla:

Hecla Mining Company (NYSE: HL)

Hecla is another stock that barely makes the list of gold stocks under $5. But the company is the largest primary silver producer in the United States, with output exceeding 13 million ounces per year — that’s about 35% of America’s total silver production, according to data from the USGS,

The company’s primary asset is the Greens Creek mine in southeast Alaska. Greens Creek is one of the largest and lowest-cost primary silver mines in the world. It produced 9.2 million ounces of silver in 2021.

The company is also a significant lead and zinc producer. According to Hecla, it is the third-largest producer of both lead and zinc. Last year the company produced 34,100 tons of lead and 63,100 tons of zinc.

Hecla owns and operates four major mines in the U.S. and Canada and is developing exploration projects throughout North America.

Unfortunately, the company’s financials have seen negative growth over the past several quarters, especially in the most recent quarter.

Hecla Mining 3Q 2022 Financial Summary

Despite less-than-desirable financials, Hecla remains in a great position to leverage rising silver prices as the most important domestic supplier of the white metal in America.

Seasonal demand for precious metals, combined with a reversal in the value of the U.S. dollar, put gold and silver miners like these in a very good position for short-term gains.

Nevertheless, the upside potential for gains from these larger gold companies is limited. The biggest gains come from the smaller, more unknown gold stocks.

They’re generally known as “junior gold companies.” Most of the time these companies aren’t mining any gold yet. Instead, they use drilling and other exploration techniques used to hunt down the yellow metal.

Now, as you can imagine, not every gold exploration effort will be successful. In fact, most of them won’t be. If they were, gold wouldn’t be nearly as valuable.

However, if you know what to look for in a junior gold company’s exploration results, you can greatly increase your odds of picking a winning gold exploration stock.

I’ve spent almost 20 years of my life looking at exploration results from gold and precious metal projects. And in all that time, I’ve only seen a handful of drill results that make me think, Holy cow, these guys found something huge.

The last time that happened was at the end of 2020. A gold exploration company called New Found Gold reported stellar drill results that no one was paying attention to at the time. I urged my readers to buy the stock at $4 a share. By May 2021, shares had ballooned to nearly $13 and New Found Gold was the most well-known gold exploration company on the planet.

Until next time,

Luke Burgess

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Leave a Reply