In this Article:

- Central Banks Are Buying More Gold

- Why Didn’t the Gold Price Rise Higher After Increased Demand

- Why You Should Buy Gold Now

Every week, we receive fantastic questions from your fellow readers. And recently, many of you have written in about gold.

Here are some of the excellent points you raised:

“I just saw your gold piece from Melbourne, Australia. Gold has had periods of big increases and big declines. So why buy gold now?” – Rex R.

“Why hasn’t gold pricing gone up by thousands of dollars per ounce? As the demand for gold by governments has gone up, it doesn’t make sense that gold’s value only increased by a small quantity over the last few years. If other commodities were in demand by world governments, prices would rise more than a few hundred dollars per ounce.” – Craig L.

First of all, thank you all for taking the time to think so thoroughly about what we publish. We value your input above all else.

Now, this week, I’m doing something a little different. I’m combining the different questions about gold, and answering them in a full essay.

Rex wants to know why you should buy gold now, given past periods of gold volatility. And Craig wonders why the price of gold hasn’t increased, given that central banks have been buying gold in recent years.

So let’s jump right in…

Central Banks Are Buying More Gold

When it comes to central banks buying gold, there’s a lot to talk about. But their increased demand for gold is true.

[Exclusive: Biden To Introduce “Biden Bucks”?]

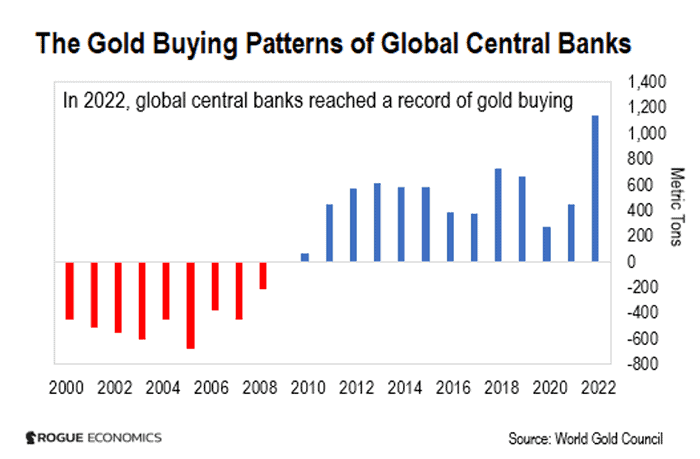

As you can see in the chart above, global central banks increased their gold buying practices in 2022.

And just during February of 2023, global central banks’ gold reserves rose by 52 metric tons.

That was the 11th month of increases in a row since June 2022.

The way I see it, central banks are the most reliable buyers of gold. That’s why they provide steadiness during periods of gold volatility.

And that’s why the more gold they buy, the more stable the price of gold becomes.

But they aren’t the only buyers. They accounted for just about a third of the overall demand for gold last year.

In addition to central banks, investors bought more gold last year than in 2021.

That’s why total annual gold demand hit an 11-year high of 4,741 metric tons.

Much of that was due to overall demand of 1,337 metric tons in the end of the fourth quarter of 2022.

That’s when the Fed reduced the pace of its rate hikes – or reached what I call Stage 1 of its three-stage pivot from rate hikes to rate cuts.

I’ll get to more of why that matters in a moment. But first, let’s dive into Craig’s question…

Why Didn’t the Gold Price Rise Higher After Increased Demand

There are a few reasons why central bank gold buying has not had a larger positive impact on gold prices.

You see, central banks added 1,136 metric tons of gold to their reserves in 2022.

That’s a record.

But, as I mentioned before, they aren’t the only buyers.

And there’s a lot of gold out there…

About 208,874 metric tons of gold has been mined throughout history. And two-thirds of that has been mined since 1950.

Of that amount, 46% has gone into jewelry and 22% into the making of bars and coins, including those purchased by gold-backed exchange-traded funds (ETFs).

Just about 17% has gone to central banks, and 15% to other places.

You see, mathematically, the 17% by central banks isn’t a huge portion of the overall gold demand. So even though we hear a lot about central banks buying gold, we aren’t seeing a sharp spike in gold prices because of that.

Their increase in demand isn’t having a larger impact on prices.

There’s another reason that central banks’ gold buying hasn’t moved the needle on gold prices.

In 2022, central banks added 1,000 metric tons to their total 35,715 metric tons of gold. That’s a lot of gold – but still only a 3% increase. And it wasn’t enough to push gold prices up by more.

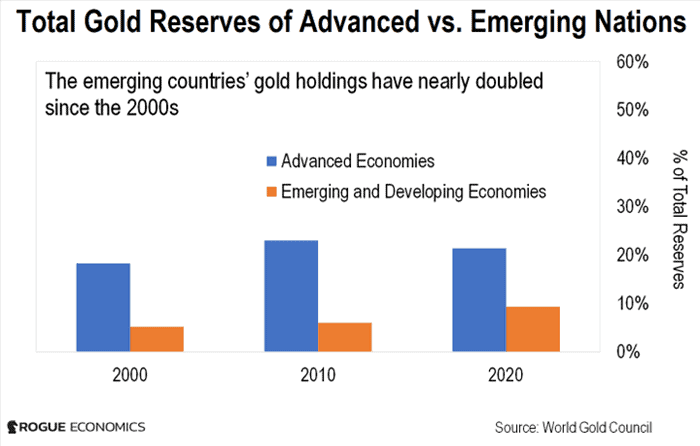

Finally, we hear a lot about emerging countries’ central banks buying gold. So why isn’t that pushing prices up more?

This also comes down to math.

You see, the gold reserve holdings for emerging countries is below 10%. Even though some developing nations’ central banks have much more than that, this still represents less than half the allocation to gold of more advanced nations.

While central banks are buying more gold collectively, and some emerging countries’ banks are buying or holding more than others, many have yet to reach a larger stockpile of gold.

Still, as you can see in the chart below, emerging countries’ gold holdings have been rising steadily since the 2000s. This growing trend represents an upside for gold prices.

[Jim Rickards: How to Ride “The C-Day Switchover” For Big Profits]

And steady demand for an asset or commodity reduces overall price volatility.

So central banks are important contributors to gold prices going higher.

Why You Should Buy Gold Now

Gold prices rose by roughly 2% in 2022. They have risen by another 7% since the start of 2023.

It’s important to know that gold has gradually and consistently risen in price – and nearly doubled since the period just before the pandemic through now.

Here’s why I believe this trend for gold will continue… and why now is the time to buy gold…

- Central banks will continue to increase their gold holdings.

That’s because central banks view gold as a currency and financial stability management tool. Gold prices relative to most countries’ currencies rise when their currencies fall relative to the dollar.

We also see the trend for emerging countries’ gold buying grow. It’s even more important for developing nations to increase their currency stability to remain economically competitive on the world stage.

- Stage 2 and Stage 3 of the three-stage Fed pivot mean that the U.S. dollar will weaken globally.

As a reminder, the Fed has been aggressively hiking interest rates since March of 2022. In just a little over a year, the Fed raised the Federal Funds rate from 0 to 4.75%.

This strengthened the U.S. dollar and caused gold prices in other currencies to increase by more than they did in dollars.

Right now, the Fed is in Stage 1 of its three-stage pivot. It includes a decrease in the size of rate hikes. Stage 2 is a pause in rate hikes, while Stage 3 is a cut in interest rates.

When the Fed pivots to Stage 2 and Stage 3, this will have an opposite effect. The U.S. dollar strength will decline relative to other currencies. That means we will see the dollar price of gold price rise by more than other currencies.

And it makes buying gold an attractive investment for holders of dollar denominated bonds or other securities.

- Inflation is slowing down as global growth is.

Global inflation is expected to fall from 8.7% in 2022 to 7% in 2023. As it does, global growth will fall to 1.7%, according to the latest analysis from the World Bank Group. That’s a sharp drop from 2.9% last year.

But inflation will remain above central bank targets of 2%. That’s due to geopolitical tensions, such as Russia’s war in Ukraine or rising friction between China and Taiwan, that will hurt global supply chains.

Persistent higher inflation will be a driving force behind more investors diversifying into gold. Remember, gold has a historic role as an inflation hedge and a wealth preservation asset.

That’s why I’ve been pounding the table on gold.

The best way to buy gold is with a combination of physical gold and gold stocks. You can buy physical gold online through accredited places like the U.S. Mint.

You can also buy a gold ETF that is backed by physical gold. Gold ETFs offer the advantage of holding gold without the hassle of storing, securing, or transporting it.

Lastly, buying into gold miners is a great way to position yourself to profit from gold’s next rally.

Happy investing…

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Regards,

Nomi Prins

Editor, Inside Wall Street with Nomi Prins

Leave a Reply