Table of Contents

- Introduction

- Who is Jim Rickards?

- “U.S. economy is deteriorating fast”

- What is the Fed going to do?

- In both the scenarios of inflation or rate hikes…

- The market sank and didn’t recover for decades…

- When do YOU think this crash is coming?

- “The Market Crash Survival Guide… Instructions for the Decades of Devastation That Lie Ahead.”

- The New Case for Gold

- How to 10X Your Money from the Coming Crash

- The 5 “Anti-Meme” Stocks Set to Soar When the Bubble Bursts

- An Important Invitation-Only Event

- Strategic Intelligence Recap

Former Advisor to the CIA, The Pentagon, The Department of Defense, and the White House says the market just let out a

“Blood-Curdling Scream”

Exclusive: In this free exclusive interview, a former government insider issues a startling message to Americans: “This will be the single fastest and deepest correction of our lifetimes and the dam is already starting to break… the markets just let out a blood-curdling scream. Many, many Americans are going to suffer”

DOUG HILL: Inflation?….a market crash?…Another bubble in tech stocks?

For most investors, it’s a confusing and tumultuous time.

With the fallout from the supply chain crisis looming…

Prices soaring across the country…

And trillions of new dollars artificially pumped in to prop up the stock market over the last few years…

Many Americans are left to wonder when is the hammer finally going to drop…

And once it does just how bad will the economic and financial fallout be?

Hi, my name is Doug Hill.

And to answer these questions today during this exclusive interview, we will be sitting down with the one man who is most qualified to tell us what lies ahead.

He and his firm have been at the forefront of nearly every major economic event of the last 20 years.

Predicting everything from Brexit to the election of Donald Trump, the Coronavirus Crash, and even the 2008 financial crisis.

In fact, in September 2006, a full two years before the 2008 financial meltdown…

He began warning our intelligence officials in Washington of a looming financial crisis.

His full thesis was so in-depth, that the CIA circulated his warning among its senior staff.

And it appeared in the CIA's official journal, Studies in Intelligence.

That material remains classified to this day.

But nevertheless, in August of 2007, he shared the same warning with officials from the US Treasury Department.

He even supplied the Treasury with a plan for averting the crisis called “Proposal to Obtain and Manage Information in Response to Capital Markets Crisis.”

But Washington still failed to heed his warnings.

So in September of 2008, just when people thought that the worst of the subprime mortgage crisis was behind us…

He wrote this letter to top advisors in the presidential campaign:

Three weeks later, Lehman Brothers would collapse, marking one of the most devastating financial crises of our lifetimes.

But anyone who listened to these repeated warnings was able to side-step the carnage.

And that’s why it’s so important that you hear this message today.

Because now, Jim Rickards – one of the world's leading economists and former advisor to the CIA and the Pentagon – is coming forward with a brand-new warning…

And it looks like some of the brightest financial minds of our time are beginning to agree …

People like billionaire investor Jeremy Grantham, a man who accurately predicted the last three bubbles is now warning that:

And Michael Burry, the man who became famous after shorting the 2008 crash is saying that we are on the cusp of:

And that:

Even Warren Buffet has joined the choir of billionaires calling for a crash:

And today, Jim is going to show us why the next few weeks may prove to be the most critical moment in your financial lifetime.

And why a massive “recession shock” being predicted by major financial institutions could bring the inevitable meltdown to our doorstep much sooner than anyone thinks.

But more importantly, Jim will show us exactly the steps he’s recommending you take to avoid the coming carnage…

Including a special investment that he’s personally put more than $1 million dollars of his own money in preparation for this type of event.

And he’ll even show you a few simple moves you can make in your own portfolio now to set yourself up to profit in the days ahead.

In fact, here’s everything we plan on covering over the next few minutes:

- First, the surprising reason why major banks like Bank of America and Deutsche Bank are warning their internal clients of a massive “recession shock” that could send the Dow plummeting by 80% or more in the coming weeks.

- Why the government and the Federal Reserve will be helpless to stop it.

- Details on a 10X crash protection that could soar as the market's tank.

- The surprising investment that billionaires like Ray Dalio, Stanley Druckenmiller, and even Lord Jacob Rothschild are flocking to right now (in fact, one billionaire has put over half his net worth in this single investment).

- And finally, the 5 unique steps you can take to help protect your investments and potentially even profit in the days ahead.

You’ll get all of that free in today's exclusive interview.

But before we get started, I should warn you…

Some of what you are about to hear WILL be controversial and offensive…

And goes against much of what you’re hearing about the markets and inflation in the mainstream media today.

So if you’re a “dyed-in-the-wool” Democrat who blindly believes in the reckless policies being championed by the Biden administration…

Or an economic Pollyanna who believes no matter what happens America’s best days are still ahead of it.

Then I can tell you right now, this message is NOT for you…

Today we have NO plans on painting a “rosy” picture of America’s future in the months ahead.

We plan on giving you nothing but the facts of the situation, and where the analysis shows that they lead…

In other words, today you are going to get nothing but the truth…if that’s what you’ve been looking for…then you’ve come to the right place.

So with that…Let me welcome the man of the hour.

Jim Rickards.

Welcome Jim.

JIM RICKARDS: Thanks Doug, glad to be here.

DOUG HILL: Jim, I’m sure our viewers are anxious to get to the subject of today’s event, so let’s get right into it.

Bank of America has started warning its internal clients that massive a “recession shock” could rock the markets in just the next few weeks, writing that:

And they even went as far to say that “U.S. economy is deteriorating fast”…

Other banks like Morgan Stanley, Goldman Sachs, and J.P. Morgan have started issuing similar warnings to their internal clients and high value investors.

In fact, Deutsche Bank just became one of the first banks to publicly admit that the U.S. is heading for a major recession, and has warned its investors to expect a correction of at least 20%.

But Jim, you’re saying this is just the tip of the iceberg…

And that this “shock” is going to be more of a “cataclysm”.

One that could send the Dow plummeting by more than 80% virtually overnight.

Can you explain exactly what this shock is? And why it’s going to have such an impact on the market?

JIM: Sure. It’s actually surprisingly simple when you understand it.

But I doubt that 1 in 1,000 investors right now see this coming.

And next to no one understands the true impact of what’s about to happen.

So let me explain it in the simplest possible terms.

Basically, by almost any measure you can think of, the market right now is in a massive, massive bubble.

Let me show you what I mean.

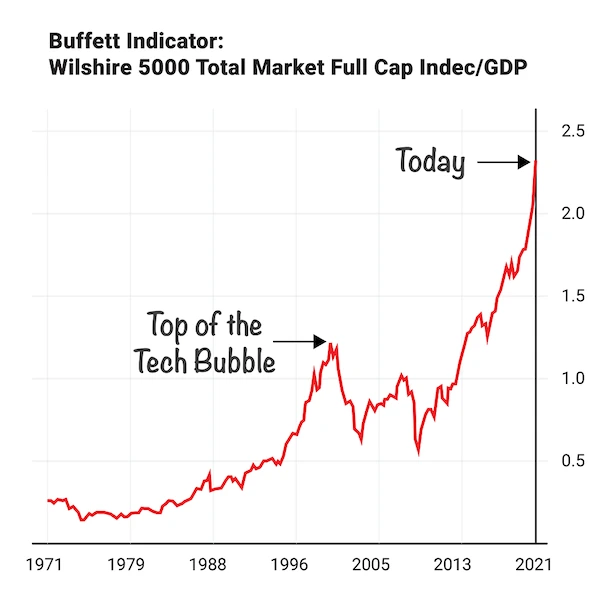

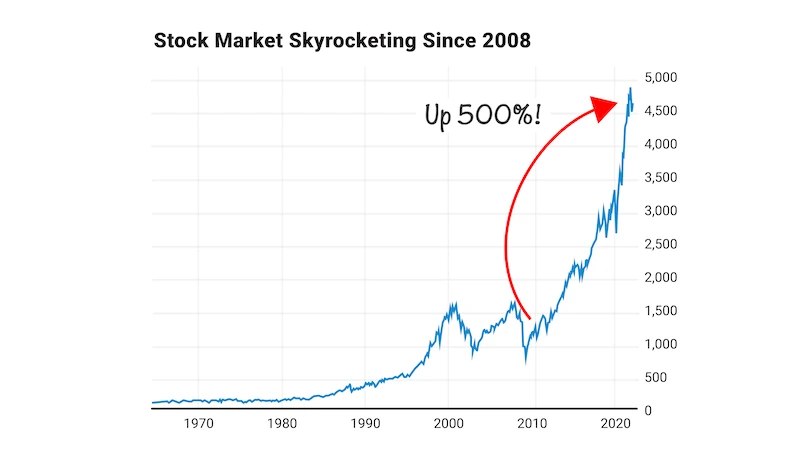

Take a look at this chart:

This is the market cap to GDP ratio…

It gives you a gauge of how much money is invested in the stock market relative to the size of the economy.

And it's Warren Buffet’s favorite indicator for predicting a market crash…

In fact, in 2000, at the peak of the dot.com bubble, when it hit its highest level in history Warren Buffet said it was a “very strong warning signal” of the crash to come.

And he was right, after it hit its peak the dot.com bubble burst and sent Nasdaq plummeting more than 77%…

And it didn’t recover for nearly 15 years.

Well here’s where that indicator stands today.

Almost 113% higher than where it was during the very height of the dot.com bubble.

That means there is more easy money flowing into the U.S. stock market than at any other point in history.

And once it goes away, it’s going to be game over for the market.

And that the next crash could be orders of magnitude bigger than the tech bubble.

Which incredible enough on its own.

But here’s the thing…

It's not the only bubble indicator that is soaring off the charts right now.

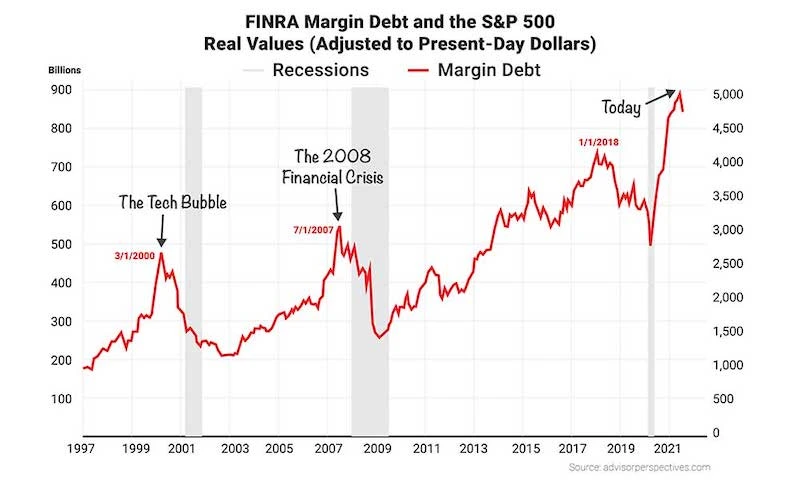

Take a look this:

It’s what’s known as the margin debt chart.

It shows us how much money people are borrowing to invest in the stock market.

Just before the dot.com bubble burst, it shot up to almost 500 billion dollars as more and more people borrowed money to buy stocks.

And just before the 2008 financial crisis it shot up again and people leveraged up their accounts with CDO and MBS and so on…

But if you thought 2008 was bad…

Well, take a look at this…

Here’s where the margin debt stands today.

This is its highest point in history…

Almost twice where it was before the 2008 financial crisis when the market corrected almost 55%.

That means there’s almost a trillion dollars of borrowed money floating around in the stock market as we speak…

And that when the next crash comes, it will be one of the fastest and most violent corrections in history.

And just to prove my point…

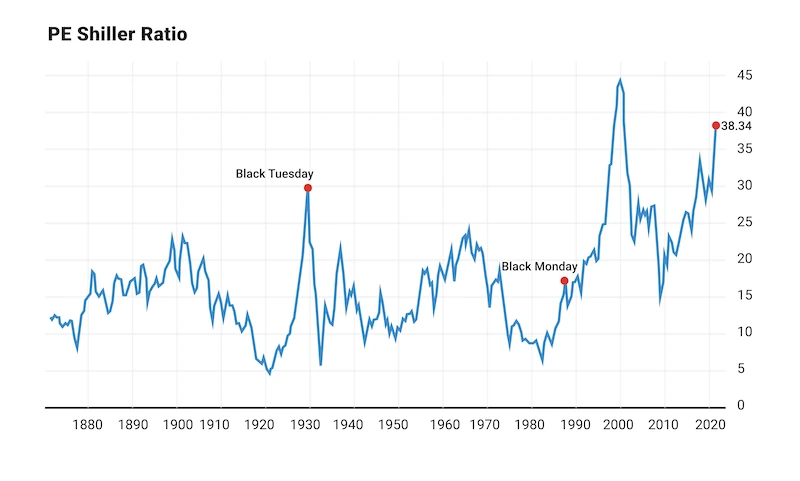

Let me show you one more chart…

This what’s known as the Shiller P/E Ratio…It’s a bubble indicator developed by Nobel Prize-winning economist Robert Shiller.

And it essentially measures how expensive stocks are compared to their earnings.

It’s at one of its highest points since the Great Depression.

Which means that stocks are more overvalued than they were in 1929.

So even a return to baseline valuations at this point represents one of the biggest corrections in financial history.

And these aren't the only indicators screaming for a bubble.

The list goes on and on and on…

But like I said, by almost every measure you can think of, the stock market today is in the middle of a historic bubble.

One that’s ripe for a crash.

All it would take at this point is a single tiny pin prick to bring the whole house of cards down.

And remember, it’s not just me saying this. Some of the brightest financial minds of our time, people I’ve mentioned before.

People like Jeremy Grantham saying this is worse than 1929.

And Michael Burry, who is saying this is the “greatest speculative bubble of all time. By two orders of magnitude.”

In fact, an entire cacophony of billionaires and leading financial minds are all singing the same tune:

So it’s becoming clearer and clearer by the day that it's only a matter of time before the bubble bursts.

But here’s the most important part…

Once it does, which as I’m about to show you could be just a few weeks from now…

There's going to be a big difference between this crash and the ones that we’ve seen before it.

After this one, the government and the Federal Reserve aren't going to be able to save us.

The stock market won’t shoot back up like it did after the Coronavirus crash or the 2008 financial crisis.

This time it will stay depressed and that could last for years, decades even.

DOUG: Now, Jim that’s a pretty bold statement…The idea that Fed will do anything to bail out the stock market during a correction is such a widely held belief that there’s a name for it.

They call it the “Fed Put”.

There are even meme’s being shared on social media of Jerome Powell printing money.

With most investors believing that the Fed is addicted to propping up the markets.

JIM: Anyone that believes that at this point doesn’t understand history, and is about to get a painful lesson in economics.

Here’s why…

You see, over the past few decades, in order to avoid any type of crisis in our economy or financial system…

We've been using every spigot we can find to pump money and debt in the system.

After the dot.com crash, Alan Greenspan lowered interest rates, forcing money into the economy and inflating what would become the housing bubble.

Once the housing bubble began to collapse, Ben Bernanke, a man I've had personal conversations with by the way, lowered interest rates even further and began something called quantitative easing, what most people consider the purest form of “money printing”..

Then, after the coronavirus hit, we lowered rates to zero, and printed a whopping 5 trillion dollars to keep the economy from complete collapse.

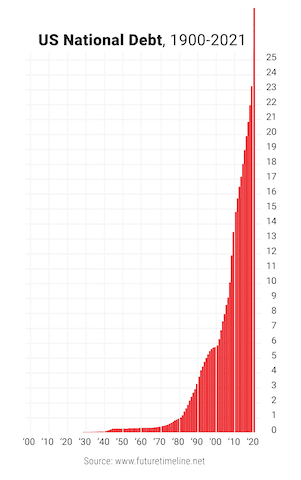

Now the U.S. debt has never been higher….

And we've never had so much money in the economy at such low interest rates.

And even though most people watching today know this is not good…

And that this can’t go on forever…

There’s one key reason the Fed has been able to get away with this.

One key reason why, for decades now, the Federal Reserve has been able to print money practically ad nauseum…

Bailing out the markets over and over again, without incurring the wrath of the American voting base.

DOUG: What’s that?

JIM: Look, what I’m about to tell you is not going to be a popular opinion…

In fact, I imagine a lot of people watching today are going to raise their eyebrows when I say it.

But if you’ll hear me out, you’ll see that I’m exactly right.

And I have the data to prove it.

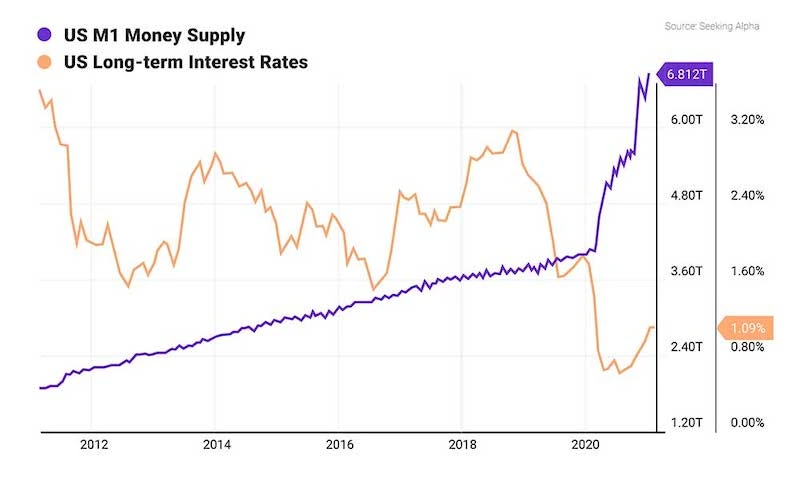

You see, over the last few decades, no matter how much money the Fed has printed…

No matter how much money they’ve added to the U.S. financial system…

Until last year…

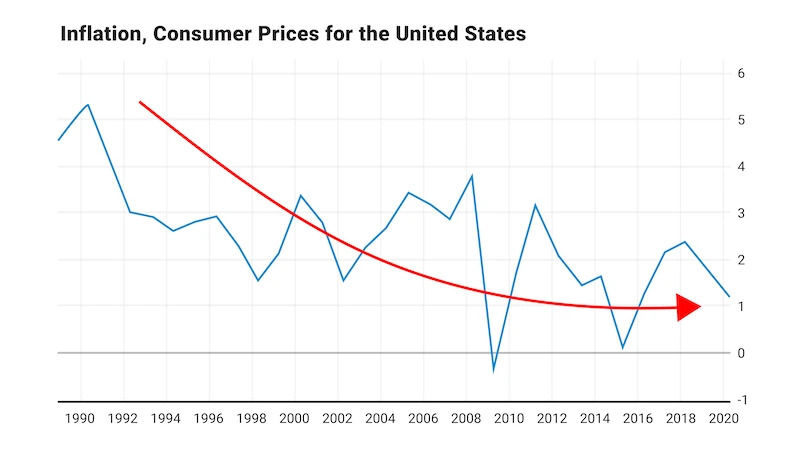

We have NOT seen massive inflation.

Not on the scales we are seeing it today.

In fact, before last year, inflation was averaging around 2% and has been declining since the 90’s.

Again, I know that won’t be a popular opinion, but it’s the truth.

You can have your own opinion, but you can’t have your own data.

And the data says that inflation for decades has been averaging around than 2% a year.

But there is a very specific reason why, despite all the money printing we’ve done over the last few decades, we have seen crippling inflation until now,

And once you understand it, you’ll be ahead of 99% of the population.

DOUG: [interjecting] Well Jim I’ve got to admit I’m pretty interested to hear this, because I know, personally I’m sitting in the “eyebrows raised crowd” at the moment.

JIM: You see, despite what your average Milton Freidman groupie would have you believe..

Money printing does NOT cause inflation.

Just think about it…

Everyone was worried about inflation under Obama after Bernanke started his “QE” program…

But it never happened.

Then again under Yellen, and then again under Jerome Powell.

But until a few months ago, we hadn’t seen it.

Why?

Because even though they are trying to force feed this money into the economy, to stimulate consumer spending…

The money is not making it to the consumer.

It’s staying in the bond market, the stock market, and the U.S. banking system.

In other words, for years now, instead of flowing into the economy and causing inflation, the newly printed money has been flowing into assets and creating huge bubbles in nearly every sector of the economy.

Just consider this…

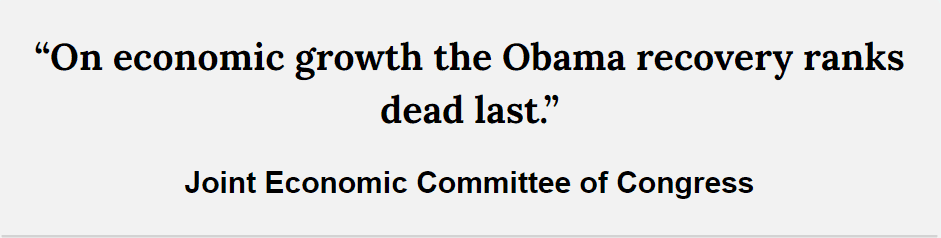

Since the 2008 financial crisis, which was the first time we lowered rates to zero and started QE, we’ve seen one of the worst economic recoveries in history.

Even the Joint Economic Committee of Congress, which is a bipartisan committee by the way, found that compared to all prior recessions, the Obama recovery was a joke:

Yet despite that simple fact, the stock market has soared by more than 500% since then.

And after all the money printing we did after the coronavirus crash last year, the S&P 500 is up by more than 75% from its lows.

And even though you and I Doug, would probably agree with Warren Buffet’s right hand man Charlie Munger when he says that this easy money mania “Must end badly”…

It’s hard to tell most people that the Fed is doing anything wrong when they are watching the values of their 401k’s and houses go up 20-30% or in some cases even doubling in less than a year.

That’s why those memes of Jerome Powell are plastered all over the internet.

He’s been stoking one of the greatest asset bubbles of all time..

And the truth is, over the past few years, people have been loving it.

Like a brain-dead surfer trying to ride a tsunami, they’ve been piling into the stock market…

Betting on bankrupt companies…

Buying up more and more risky penny crypto investments…

And selling nearly worthless NFT’s…

All with the idea that with the easy money the Fed is throwing at the economy, they can have a chance to get rich.

In fact, it was recently reported that investors put more money in stocks in just a single 5-month period, than in the previous 12 years combined.

DOUG: Jim, that’s a pretty incredible statistic. More money into stocks in 5 months than the last 12 years!? That can’t be healthy…or sustainable.

JIM: It’s not, Doug.

And that giant wave they have been riding is starting to break.

And that brings me to the situation we have today.

You see, for reasons I’ll explain in just a moment…

For the first time in nearly 40 years, we are seeing inflation on a massive scale.

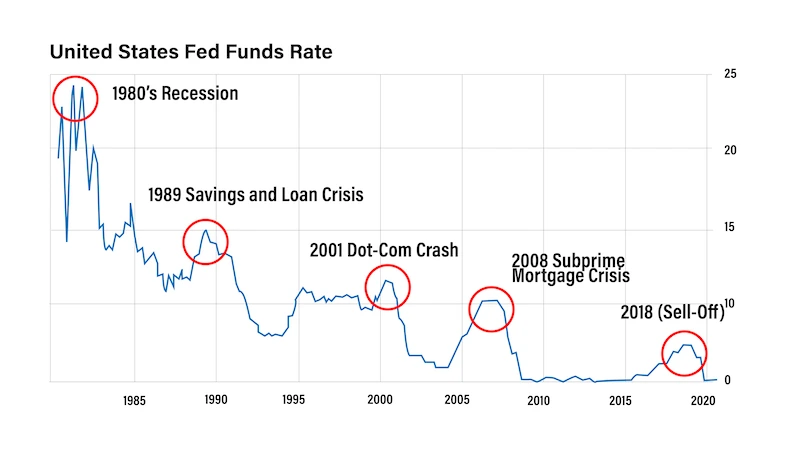

And the only tool the Fed has to fight inflation is raising interest rates and cutting off the easy money that has blown this bubble up.

But as I showed you before, interest rates are already at one of their lowest points in history…

And every single time that the Fed has tried to raise them, we’ve suffered a massive market crash.

And each time we had to raise them less and less before the market caught on and panic set in.

This is what happens when you build a massive stock market, and real-estate bubbles on top of easy money policies.

Eventually there is no way out.

And we are entering a “final phase” where the Fed has to choose between raising interest rates and stopping inflation, keeping this giant bubble going.

And as I’m about to show you neither is a good choice.

DOUG: So Jim, basically what you’re saying is that the Fed is cornered.

They can either let inflation destroy the American economy…

Or they can raise interest rates and deflate the largest bubble in the history of the world.

JIM: Exactly, and it’s not just me saying that.

Members of the Federal Reserve Board are already starting to admit this.

In fact, Former Federal Reserve economist Nouriel Roubini has said:

And that when they do:

Gary Shilling, a former member of the Federal Reserve, is saying that when this crash inevitably happens that:

And even the President of the New York Fed himself is saying that:

That’s why it was so important for me to get this message out as soon as possible.

Because no matter which option the Fed chooses, as that former Fed economist said, a lot of people will suffer.

And in ways most people don’t expect.

In fact, I like to compare, the Fed’s dilemma today to the one faced by Odysseus in Homer’s epic poem, The Odyssey…

As Odysseus was returning home from the Trojan war…

He was told that in order to get home must take one of two paths.

One path will take him by Scylla…

A six-headed monster who devours all within reach.

On the other path lay Charybdis…

A nearly impassable whirlpool capable of swallowing entire fleets of ships whole…

Either had the capacity to lead to massive destruction, and both would almost certainly lead to death of at least part of Odysseus’s crew.

In other words, it didn’t matter which way he picked.

Men were going to die. There were no good options.

So of course what Odysseus does is lie to the men about the dangers they were about to face, and just picked the least bad option.

And that’s exactly the situation our policy makers face today.

No matter which path they choose…

Not everyone is getting out of this next financial crisis alive.

And rather than tell you what’s about to happen, they’d rather just pick the least bad option and sail ahead.

That’s why it was so important for me to get this message out today. To show you the reality of what’s about to happen.

And show you the fine line that investors are going to need to walk to be some of the few who do make it out of this next correction alive.

DOUG: Now Jim, this isn’t something you’re talking out of school on.

As an asymmetric financial threat expert, you’ve advised the CIA, the Pentagon, the Department of Defense and even the White House…

In fact, you were one of the men who help the Nixon Administration craft the Petro Dollar Accord in the 70’s.

You helped the Reagan Administration negotiate the end of the Iranian Hostage Crisis in the 80’s.

You’ve been tapped by various intelligence communities to build systems for tracking terrorists through the financial markets…

Assess threats of overseas companies that wanted to do business in America…

And even to run economic wargames to stress test the U.S. financial system against attack.

I mean, time and time again, our government has turned to you during times of crisis.

But most relevant to our conversation today was your work in 1998, after the hedge fund Long-Term Capital Management blew up and threatened to take down the entire U.S. financial system…

You were called in to work side-by-side with members of the Federal Reserve to prevent a complete collapse of confidence in the banking system.

And because of your actions that day, you were one of the subjects of a book called, When Genius Failed.

A book that went on to become a national bestseller.

So you know exactly how the Fed works and operates.

JIM: Look, I’ve been inside the boardroom at the Federal Reserve.

I’ve had personal conversation with guys like Ben Bernanke, Timothy Geithner, all of these guys.

And they know the writing is on the wall.

They may not know the exact severity of the crash they are about to cause.

And they are way behind the curve on inflation.

But they know this is coming.

DOUG: Now Jim, in your book Aftermath, which was released in 2019…

You cautioned that many of the issues we faced in 2008 were never fully resolved.

You even outlined the Scylla and Charybdis situation much like the one that we are seeing today.

And even more stunningly, you warned that a global pandemic could be the cause of the next financial crisis…

And that a crisis of this proportion would happen with “near 100% certainty” within the next few years…

Just four months later, we got the first reported case of the coronavirus…

Which has to be one of the most timely calls in financial history.

So now that we are seeing this crisis unfold almost exactly like you predicted…

Can you give us an update and outline exactly what our two options are and what you see playing out in the markets?

And more importantly, what people today can do to protect themselves?

JIM: Sure.

Let’s talk about the first option, or what I’m calling Charybdis.

This is the option the Fed wants to avoid at all costs.

I’m sure some of you watching right now remember the 1970’s.

When inflation was hitting all-time highs…

Unemployment was skyrocketing…

And the price of oil shot up so fast that the government starting rationing it to try to reign the price back in…

And only way you could buy gas was on certain days of the week based on your license plate numbers.

DOUG: I remember that. It was a scary time. Jim, do you think that it’s fair to say that up until 2008, that period was one of worst financial economic crisis of most people’s lifetimes?

JIM: Absolutely.

Food prices shot up 248% in some cases.

The crime rate nearly doubled.

In fact, things got so bad during that time that there were even riots in the streets as truckers protested the rising price of gas…

Could you imagine something like that happening today? With political and economic tensions at all-time highs?

DOUG: It’d be like igniting a powder keg.

JIM: Exactly, that’s why there’s a huge imperative to stop it before it starts.

That’s why the Fed is raising rates to try and get it under control.

But it’s not going to work, at least not in the near term.

That’s because, like I said before, the inflation we are seeing today isn’t caused by money printing.

It the result of the same thing that happened in the 1970’s…

Supply shocks.

You see, in the 70’s because of two separate oil embargos, the price of oil shot up from around $3 a barrel in 1970 to almost $35 a barrel in 1980.

As this single supply shock rippled throughout our economy, it was enough to send our country spiraling into some of the worst economic chaos in modern memory.

But today…?

It’s a lot more than just oil.

Because of the war in Ukraine, and the fallout from the coronavirus lockdowns, we are seeing massive supply shocks nearly everywhere we look…

Everything from food, to gas, to electricity are all in short supply.

Videos are showing empty shelves across the U.S.

Energy prices have already increased 32% and are showing no signs of slowing.

And gas prices continue to soar…

That’s why people like Ray Dalio, and former treasury Secretary Larry Summers are saying this “is starting to feel a lot like the 1970’s” and this will be “like the 1960’s [and 70’s] on steroids”.

Oh and by the way, if you think stocks are a good way to hedge against inflation…

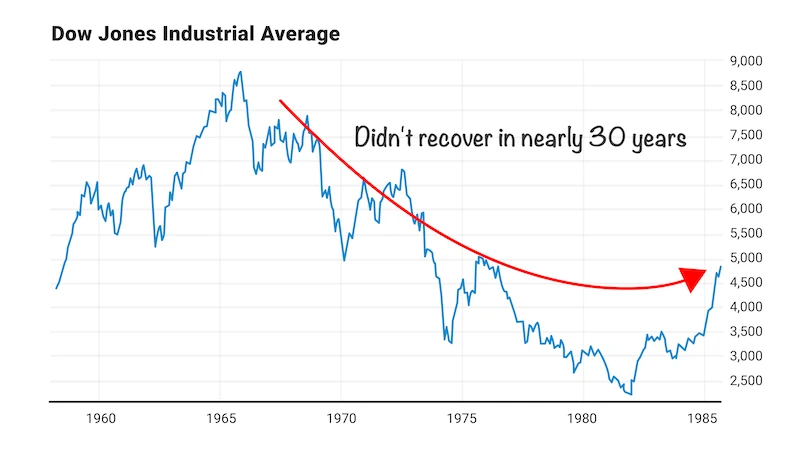

Just look what happened to U.S. stocks during that time.

After its peak in 1965, the Dow Jones fell by nearly 74% and didn’t recover for nearly 30 years.

DOUG: So as people were watching prices soar they were watching the values of their retirement accounts plummet?

JIM: Exactly. That’s what made this time so painful.

And why you have to pick your investments very carefully during a time like this.

But the truth is, we were lucky. Things could have been a lot worse.

In fact, even though most Americans don’t realize it.

Britain went through the same exact thing in the 1960’s and 70’s.

They had supply shocks running throughout their economy, and labor was in short supply.

Just like in America today.

And soon the prices of everything began to rise.

And before you knew it inflation was up more than 24%, almost double what we saw in the U.S. during the 70’s.

Can you imagine losing almost a quarter of your wealth in a single year?

In fact things got so bad that between the period 1973 -1978 of anyone holding British pounds lost a little over 63% of their wealth.

DOUG: 63% in just a few short years?!

JIM: That’s right.

Of course this was an absolute economic calamity for anyone living there at the time.

The government tried issuing price controls, people were only allowed electricity three days out of the week.

There were even reports of waste workers just letting garbage pile up on the streets,

And gravediggers not showing up for days to help bury the dead.

I mean, who wants to show up to work when have your wages will be eaten up by inflation?

Now to be clear, I don’t think things will get that bad in America.

Not yet at least.

But the point is this, inflation from supply shocks is a massive political nightmare.

One that Americans haven’t seen on a scale that we are seeing today for the last 50 years.

And the Fed won’t be able to just sit idly by as this all plays out.

DOUG: Okay Jim, so what is the Fed going to do? If that was Charybdis, what is Scylla?

JIM: Their plan is to raise rates and tighten into weakness.

They might not get far, but they won’t need to before this massive bubble we’ve inflated over the last few decades bursts.

Let me show you what I mean.

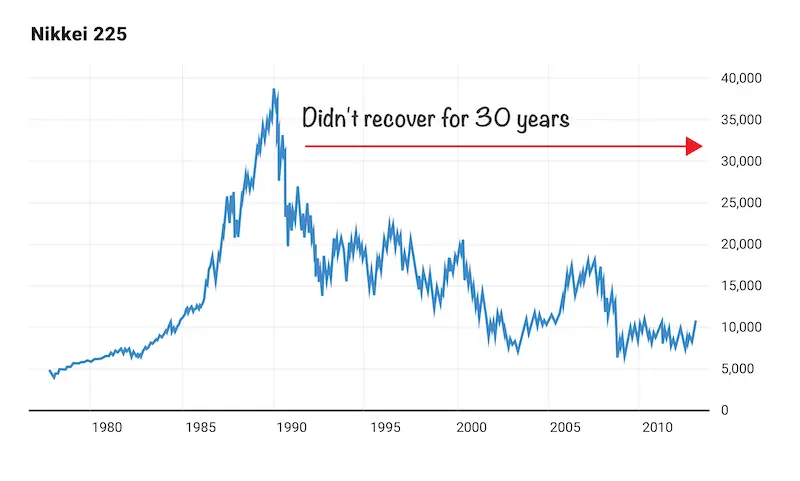

Take a look at what happened to Japan in the 80’s.

They were in a nearly identical situation.

They had inflated a massive asset bubble through low rates and easy money.

In fact, at first everything seemed great…Their real-estate and the stock markets were hitting all-time highs.

Just like America today.

Then on May 30th of 1989, in order to try and slowly deflate the speculative bubble, the Bank of Japan decided to raise interest rates…

Within months the stock bubble burst and the Nikkei fell by over 60% in just a few short years.

Economic growth slowed to a crawl. Millions of people lost their life savings.

And Japan experienced three lost decades.

Which by the way, means anybody that was at retirement age in the 1990's lost over half their wealth.

Wealth that was never recovered in their lifetime.

And that’s exactly where people like Charlie Munger and Ray Dalio are saying we are heading today.

And it’s important to remember that even though the Bank of Japan reversed course quickly and did everything they could to stimulate the economy…

Printing money and keeping interest rates at near zero…

Nothing worked…

After they began raising rates, the bubble popped.

The value of everything from stocks, bonds to real estate fell.

And never recovered in most people’s lifetimes.

And according to the U.S. Fed’s own admission that’s exactly what they are planning to do today.

They’ve already announced the first few rate hikes, and they are expected to have several more announcements this year..

And each is getting bigger than the last.

It’s only a matter of time before something breaks.

That's why it is important that if you have money in the markets…

You make some of the moves we are going to talk about today immediately…

Because you may not get another chance in your lifetime.

DOUG: Now Jim, I want to talk about this for just a moment, because I feel like this is an important point.

In both the scenarios of inflation or rate hikes, the market sank and didn’t recover for decades.

So for those of you watching today that are at or nearing retirement…

Just imagine what a lost decade, the kind that Jim is talking, about would mean to you.

Could you withstand losing over half your portfolio's value in just a year? Then watching it stay there for more than a decade or even two?

What would that mean to your lifestyle in retirement…what would it mean for the people in your life who rely on you…or to the people you may have to rely on during those difficult times?

What would it mean to the inheritance you planned on leaving to your children or your spouse?

I know these are hard things to consider. And our goal today isn’t to scare you.

But it’s important to remember that the small consequences of acting too early in this case are nothing compared to the dangers that come from acting too late.

That’s what makes Jim’s message today so important.

And it’s exactly why you should make some of the moves he’ll be recommending here in a moment.

JIM: And it’s important to keep in mind that Japan isn’t just some far off example.

This happened right here in America too…

Just look at what happened in America during the 1929.

During the 1920’s the U.S. had a spectacular bull market.

It was fueled by cheap credit and easy money…

Just like in America today.

In fact, trading on the exchanges had become a national past-time.

People were borrowing money to buy stocks.

Just like the people that are “borrowing on margin” today…

But 1928, seeing a massive bubble beginning to form, the Fed decided to raise interest rates, and tighten into weakness.

And again, within a matter of months, the bubble burst…

And market fell by more than 85% within a few short years…

Wiping out the wealth of millions of Americans…

And leaving a scar on the American psyche that didn’t heal for decades.

DOUG: And that’s the kind of crisis you think we are heading for today?

JIM: Look, it’s not just me saying that…it’s some of the brightest financial minds of our time:

In fact, Jeremy Grantham, the man who is credited with predicting the last three bubbles has said that:

And that:

Carson Block, the founder of Muddy Watters Capital, has been reported as saying this crash is:

And the Hussmann fund, which not only predicted the 2008 financial crisis…

But made the impossibly accurate prediction in March 2000 when they said tech stocks would plunge 83%, right before dot.com bubble burst and the Nasdaq went on to plunge by exactly 83%, is now saying that:

And that:

Even Gary Shilling, the former Federal Reserve member, is saying that.

In fact, nearly everywhere you look right now, people who know about markets and finance are beginning to say the same thing…

That this market is heading down, and its heading down much faster and more violently than most people can imagine.

And once this crash hits, it will not be pretty.

But here’s one of the most important things to remember, the government cannot print its way out of this next crisis.

Remember during the Great Depression, it took the markets almost 30 years to recover its losses and for the economy to recover…

And no amount of fiscal stimulus got us out of it.

You might remember FDR’s New Deal, where we spent billions creating programs like Worker Progress Administration to provide jobs for the unemployed…

Instituting the Social Security Act, and on and on.

In fact, most people don’t realize this but between 1933-1937 the money supply increased by more than 42%.

Still nothing worked.

It took repricing gold in dollars and essentially devaluing the currency by more than 40% overnight to get the economy jump started again.

And it wasn’t until decades later that the stock market followed.

That’s exactly why my research says that this coming crash is absolutely inevitable, and why the Federal Reserve and federal government will be nearly helpless to stop it.

And why anyone watching today follows the exact guidelines we are about to detail.

DOUG: Okay Jim, so what’s the flash point here? When do YOU think this crash is coming? When are the markets going to catch on to the reality of this situation and start selling off?

JIM: Well, I’d like to give you some good news here Doug…

But the truth is the markets are already starting to catch on.

Major banks like Deutsche Bank, Morgan Stanley, Goldman Sachs…

In fact, Deutsche Bank released an internal report to its clients saying that…

Which means these interest rates hikes are almost certainly going to cause a crash.

And JP Morgan just added more than $902 million dollars to its loan loss reserve.

It’s biggest increase since the coronavirus crash in 2020…

Which means they could be expecting a massive wave of defaults soon…

And it makes sense why.

Almost every technical indicator for a market crash is flashing red right now.

For instance, you may have seen in the news that the yield curve inverted.

DOUG: Yes, I actually did see that.

JIM: Well, that’s happened before every major U.S. recession. It has close to a 98% accuracy rate of predicting a recession.

And if that’s not bad enough, Eurodollar futures have started signaling a crash as well, which means something on the scale of a global financial crisis could be just ahead.

Even major hedge funds have started calling for it.

Like the Hussman Fund and Jeremy Grantham’s fund, which has over 118 billion dollars under management.

In fact, a leaked letter from the Nassim Taleb advised Black Swan Fund, a firm that pulled in a 4,000% return from the Coronavirus Crash is now warning their clients that a bigger crash is coming.

And by the way, you have to 50 million dollars in assets just to have Black Swan fund manage your account.

So if you’re looking for clearer signs than that, you won’t get any.

Essentially the market is letting out a blood-curdling scream that this crash is coming hard and fast.

So the time to get ready for this crisis is right now.

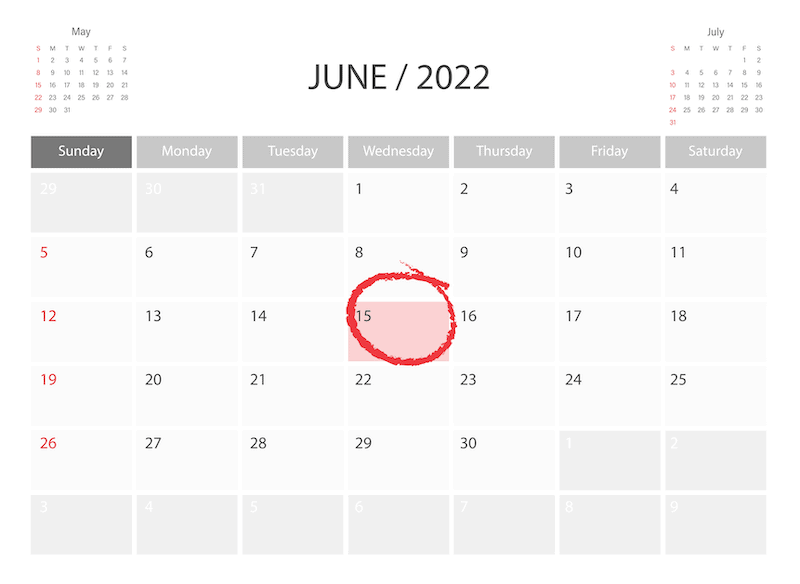

But if you asked me to pick a date, a date when I think we will have reached a tipping point, I’d tell you to circle this date on your calendar.

Here’s why.

You see, the entire world right now is caught in limbo right now.

Will the Fed raise or won’t they?

Are they going to let inflation run rampant and destroy the economy, or are they going to tank the markets by raising interest rates?

And that’s the day I anticipate we will get an answer.

That’s the date of the next Fed meeting when they decide whether or not to continue to raise interest rates.

If they raise them by anything more than a quarter of a percent, which looks more and more likely by the day…

Then they will signal to the markets what their plan is.

And the markets could begin a major sell-off the very next day.

Remember, we saw it happen in Japan in 1989, we saw it happen in America in 1929.

There is no reason it can’t happen here.

And the good news is, no matter what they decide, whether it’s to crash the markets or let inflation run wild…

The investment strategies I’m about to detail could do very well.

In fact, like I’ve said before, I’ve put over a million dollars of my own money in some of these investments so that should tell you just how confident I am.

DOUG: Okay, let’s get into these investments. What should people do today to prepare?

JIM: Well, there are some relatively simple moves that you can make to help insulate yourself from the coming carnage.

I’ll cover some more unique investments in just a moment…

But the first thing I recommend is doing whatever you need to make sure you have enough cash on hand to cover at least 3-6 months’ worth of expenses.

An emergency fund, if you will.

I know that sounds counterintuitive.

Especially if we see inflation.

But remember, plenty of people will get wiped out in the early stages of this crisis as the market crashes…

And a market crash is more than just about the stock market.

People will lose their jobs, their homes, and watch their retirement accounts shrink to nothing.

Think 2008 on steroids.

So having a little cash on hand will ensure that you are well insulated against the coming storm.

Besides this emergency fund, I also recommend moving a large part of your portfolio to cash as well.

I’ll show you what to do with the rest of your portfolio in a moment.

But having a large cash position will limit your downside during a crash and give you plenty of dry powder to enter back into the market at rock bottom prices once the bloodbath is over.

As the old Wall Street adage goes…best time to buy stocks is when there is “blood in the streets”.

And once this happens, there will be plenty of blood spilled.

Having cash both in your personal accounts and in your portfolio means you’ll be one of the sharks instead of the prey.

DOUG: Jim, that makes a lot of sense. I think a lot of people on today’s call, myself included, wished they had gone to cash before 2008 and then bought back in at rock bottom prices.

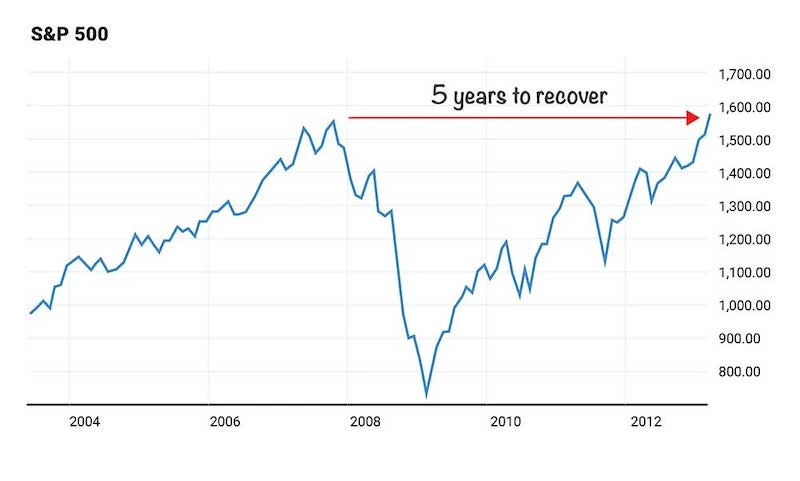

I mean, the S&P 500 was cut in half during that time. Anybody that tried to ride it out in stocks had to wait at least 5 years for the markets to recover.

But anybody that went to cash and bought even just a run of the mill index fund anywhere close to the bottom of the market could have doubled their money in the same time frame.

JIM: Exactly. That’s why having cash right now is so vital. And like you said you could have done that with a run of the mill index fund.

But with the recommendations I’m going to be making today, you’ll have a chance to do much better than just doubling your money.

In fact, if done right, a market crash is one of the few times where you can make life changing gains in a short period of time.

Like some of the top plays I’ve recommended to my readers in the past. They had the chance to see gains of 1,000% or more in just a matter of days as stocks fell.

And I fully expect some of the plays I’m going to detail in just a moment could deliver you the same kind of profit potential during a crash.

DOUG: Now Jim, I’m excited to get to those plays, but before we go any further…

I know that in addition to going to cash, you’ve broken down everything you’re recommending into 4 simple steps readers can take to set themselves up to profit in the months ahead.

We’ll cover them in just a moment…

But first, I’d like to let the viewers know that you've done everyone watching this call today another tremendous favor.

Jim has taken everything we’ve talked about here today and compiled it into a special dossier titled, “The Market Crash Survival Guide…Instructions for the Decades of Devastation That Lie Ahead.”

In it, you’ll find all the facts and figures we’ve talked about today along with a few special investment opportunities we will be covering on today's call.

It includes things like:

- The ONE investment you need to be making right now.

- Specific portfolio allocations for the coming correction.

- 5 unique investments that could give you massive returns during a market crash.

We’ll go into more detail on some of these strategies in just a second.

But considering that in the past Jim’s dossiers have been the subject of study by the CIA, and have been circulated at the highest level of the intelligence community, and even requested by members of the senate and congress.

It’s hard to put an exact price tag on the value of receiving this type of dossier yourself.

However, for reasons that we will explain a little later, after we’ve gone through all of the recommendations.…

Jim has generously offered to make this dossier available for immediate download to anybody viewing this presentation today.

We’ll show you how to claim your copy in a moment.

But let’s go ahead and get into some of the specific recommendations now.

Jim, in addition to going to cash, what else should our readers be doing?

JIM: Well, the one mistake I see almost 99% of investors make is not properly allocating their portfolios.

That’s why I break down all of the portfolio allocation in the dossier…

And the first step I’m going to recommend is that you allocate at least 10% of your Portfolio to what I call “the world’s most indestructible asset”.

Step #1: Put Up to 10% of Your Portfolio in World's Most Indestructible Asset

There is one asset that performs surprisingly well during times of crisis…

And it will be the single most important safe haven for what lies ahead.

In fact, Ray Dalio, one of the men who has been warning about a correction, has invested more than $400 million into this one asset.

And billionaire investors like Paul Singer, Paul Tudor Jones, “Bond King” Jeffery Gundlach, and even Lord Jacob Rothschild have been flocking to this one asset.

Now it may surprise you when I say this…

But I’m talking about owning gold, but not in the way you might think.

You see, most people only think of gold as an inflation hedge.

And they are right, gold does tend to do well during times of high inflation…

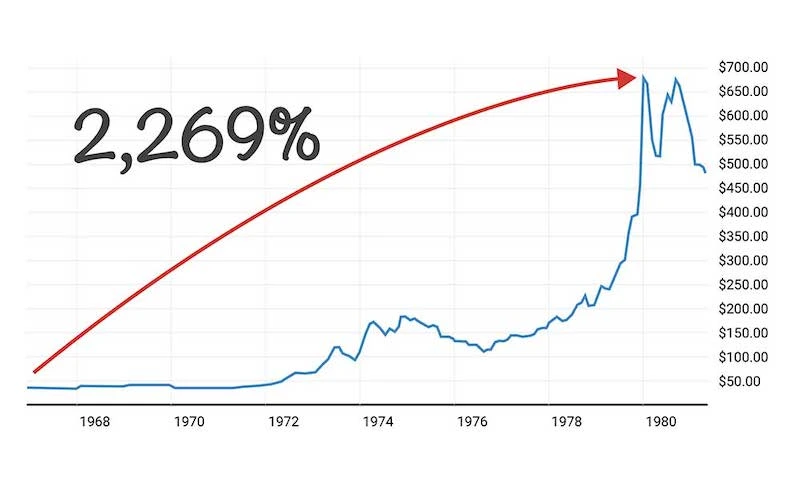

In fact, during the stagflation of the 1970’s, gold shot up over 2,269% during the course of a decade.

So by owning it, you’ll be well protecting from any inflationary scenario.

But here’s what most people don't realize…

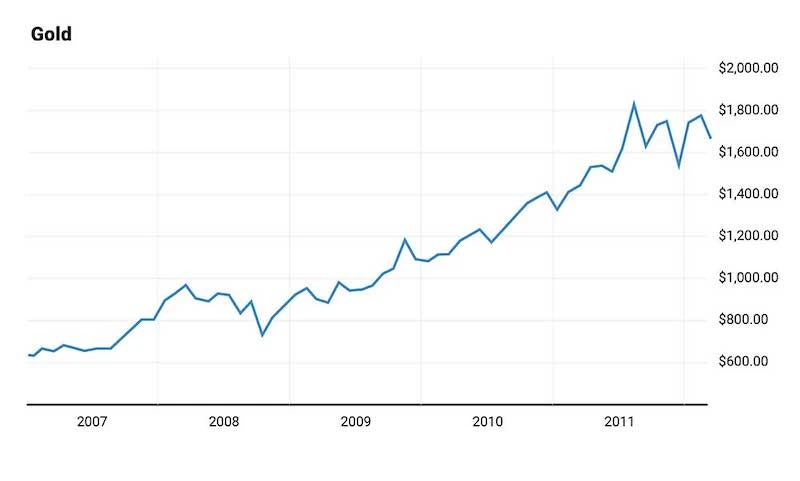

That in the years following the 2008 financial crisis, the biggest market correction of our lifetimes…gold did tremendously well.

That’s because, as USA Today put it, regardless of what’s happening, “humans turn to gold in times of crisis.”

And Egyptian billionaire Naguib Sawiris, a man who recently put half his net worth in gold said people “tend to go to gold during a crisis and we are full of crises right now.”

And he is exactly right.

That's why I like to call gold the world's most indestructible asset.

And here’s the best part…

Gold is a win-win investment in my opinion.

If we do get a deflationary market crash, gold will do well. If we get runaway inflation, gold is the best place to be.

That's why billionaires are taking stakes in gold right now…

I think it’s safe to say that gold has a long, long way to run in years to come.

In fact, as this crisis unfolds, I believe that gold itself will hit at least $14,000 an ounce in the coming years.

That’s why, in order to protect my family's wealth, I’ve invested more than $1 million of my own money in gold, and some special gold related investments I’ll detail here in a moment.

And I recommend you move 10% of your investable assets to gold.

But here’s the problem, many people go about investing in gold in exactly the wrong way…

You see, thanks to my deep connections in both the intelligence and financial community…

I’ve probably been allowed to do more in depth research on the subject of gold investing than anyone else…

In fact, Forbes jokes that I’m the James Bond of gold.

Because I fly all over the world looking for these types of investments.

Even visiting the secret gold vaults in Switzerland, whose location I’m not authorized to disclose.

But all jokes aside, I think it’s safe to say that no one has had the kind of insider access I’ve had on the subject of the yellow metal.

That’s why I’d like to offer to send along a copy of my book, The New Case for Gold, to everyone watching today.

It includes many of the finer points of gold investing and details why it may be the best investment for the coming decade.

It includes things like:

- The secret lever the government still has left to pull during the next crisis and why it would send gold to $14,000 overnight (It’s only been used once before, and Trump was a big supporter of it. In fact, he said making this move “would be wonderful.” Pg. 34)

- The REAL reason Russia and China have been secretly buying up gold by the metric ton (and what it means for anyone investing in gold now. Pg. 43)

- The 5 secrets of the worldwide gold manipulators and how to take advantage of their schemes to profit (Major banks and governments around the world are using schemes to manipulate the price of gold, but you don’t just have to be an innocent bystander in this game. In fact, you can use this information to your advantage and make a lot of money. Pg 108)

- The U.S. government’s secret scheme for removing physical gold from circulation (and why you should NEVER store your gold at a bank.)

- The three countries where you can easily and safely store some of your gold outside of U.S. borders (Plus, a special depository located in Texas that is protected by the Tenth amendment where you can vault your gold without fear of confiscation from the U.S. Government.)

- A new “shadow gold standard” that is being used by world leaders (and why a special type of gold investment could give you a “seat at the table” during the next monetary reset.)

- My favorite way to invest in gold mining stocks (and how it helps you avoid the #1 mistake nearly ALL gold investors make.)

I believe that this book will be the single greatest resource on gold investing in the years to come.

And even though it retails for almost $26 in bookstores across the country, I’ll send everyone watching today a FREE hard-cover copy of my book when they claim their dossier.

DOUG: And for everyone watching today’s call, Jim has included an additional hidden chapter of this book.

One that’s not available in any print version, and has never been released anywhere before.

In it, he details some of the most unique gold and precious metal investment opportunities that he has come across in his research.

Like:

- Jim’s #1 Gold Play for 2022 – A special development taking place in the Arctic as we speak. It’s something that very few people realize is happening let alone how to invest in it. But here Jim will guide you through exactly what this is and how to stake your claim.

- The World’s Last Pure Silver Mine – A little known silver mine that trades for less than $4 a share that may be sitting on the largest deposit of pure silver in the world.

- Secret Island Silver – A special silver coin from a secret mint located off the coast of the Cook Islands that has unique properties which make it substantially more valuable in a time of crisis.

Now Jim, some of these investments are incredibly unique and things I’ve never seen anywhere before.

Can you detail some of them for the audience?

JIM: Sure. In fact, in addition to the dossier and a copy of my best-selling book, I brought a special gift along today for any viewer that wants to claim one..

Can we get a close up shot of what I’m holding in my hands?

Take a look at these:

These may look like old continental dollars, or maybe even gold certificates to you.

But they are far more valuable than any of that.

These are actually thinly printed sheets of real gold that have been covered in a nearly indestructible protective polymer.

See how they look and feel almost just like real cash.

And they have their own protective security marks printed on them just like a U.S. $100 bill.

They come in multiple denominations ranging 1/1000 troy ounce all the way to 1/20th of a troy ounce.

And what makes them so interesting and so potentially valuable to everyone watching today, is that they could solve one of the biggest problems with storing physical gold for worst case scenarios.

You see, during a time of crisis it’s nearly impossible to use physical gold for barter.

That’s because a single 1 ounce American Gold Eagle is worth more than $1,900.

But with goldbacks, you could trade much smaller denominations of gold as easily as you can a few dollar bills.

And because of the materials required…

And the government-level security features on each bill, they are nearly impossible to forge.

And as we speak they are being printed as an alternative currency in places like Utah, Nevada, and New Hampshire.

And they are legal to spend and use anywhere in the United States.

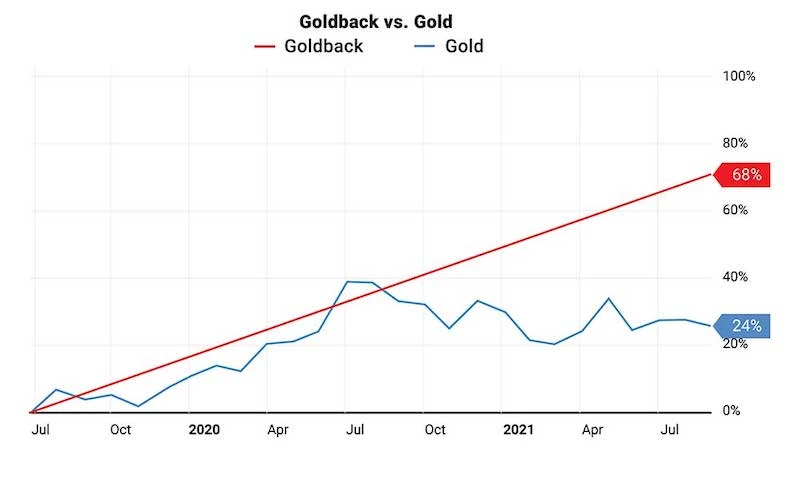

And here’s the best part…

Since they started being minted a little over two years ago, they’ve been soaring in value at twice the rate of gold.

Which means that as gold rises in value, these could skyrocket.

In fact, if gold does go to $14,000 an oz, it's not unthinkable that these will trade at twice the spot price of regular gold.

Which means that each one of these goldbacks could become incredibly valuable.

Of course, they are new type of speculative investment and nothing in the market is guaranteed, but…

They’re usefulness as an alternative investment is all detailed in this new chapter.

Including where you can get these goldbacks and special vaults where you can have them stored for free.

DOUG: They are truly beautiful pieces of work. I could see these being incredibly useful to have during a crisis.

I could even see them being passed down from generation to generation like a family heirloom.

JIM: I’m glad you think so Doug, because this one's for you.

In fact, I think it’s such a good idea for people to keep physical gold on hand in addition to their cash reserves.

When you claim a dossier today, along with everything else we are sending out, I want to send one of these along as well.

DOUG: Thank you Jim. That’s incredibly generous of you.

And we’ll show everyone how to claim Jim’s gift in just a moment along with a copy of his book and the dossier.

But first Jim, I’d like to turn our attention to the second step you mention in this dossier.

Step #2 How to 10X Your Money from the Coming Crash

In that section, you recommend people buy something you refer to as “portfolio insurance.” Can you take a second and explain how that works?

JIM: This is a very special type of crash protection play that very few investors even realize exists.

In fact, it’s similar to the secret that Joseph Kennedy, the father of John F. Kennedy used to launch the Kennedy family fortune right in the middle of the 1929 crash.

And nearly identical to how billionaire Mark Cuban protected his investments and profited more than 1.4 billion dollars during the dot.com crash.

And this type of “portfolio insurance” play is one of the most powerful wealth-building tools you can have in a time of crisis.

And I’ve found a way that allows even average investors to get in on this opportunity…

Without having to “short stocks” or anything complicated like that.

And the results have been absolutely incredible.

In fact, the handful of the people who I’ve shown this strategy to in my high-end research services have reported back making as much as 1,300% returns in a little under two weeks.

To taking home over 1,000% returns in just as fast as 2 days.

Of course, those are rare and exceptional examples, obviously the markets and stocks don’t crash everyday allowing you to get these kinds of payouts…

But it shows just how powerful this strategy can be…

And I’ll lay out everything in the special dossier I’ve put together for today's event.

But here’s the most important point…

Returns like that are a big reason why I DON’T recommend just going into cash and sitting on the sidelines during this crash.

You see there are plenty of moneymaking opportunities to take advantage of along the way.

DOUG: Speaking of which, let’s go ahead and talk about a few of those opportunities right now.

In step 3 of the dossier you talk about investing in “Anti-Meme stocks”. Can you explain exactly what that is?

Step #3 The 5 “Anti-Meme” Stocks Set to Soar When the Bubble Bursts

JIM: Right now millions of investors are trying to chase gains at the end of the bubble…

You've probably heard of “meme” stocks like AMC, GameStop, and Hertz

But it's a dangerous game because most of these companies aren't fundamentally sound.

Just take a look at these headlines.

This kind of “gambling” strategy is a clear sign of a massive bubble on the verge of bursting…

But here’s what most people don’t realize.

By positioning yourself now, there is as much opportunity to make money on certain stocks during a falling market…

Rather than just trying to chase them on the way up.

Let me show you what I mean…

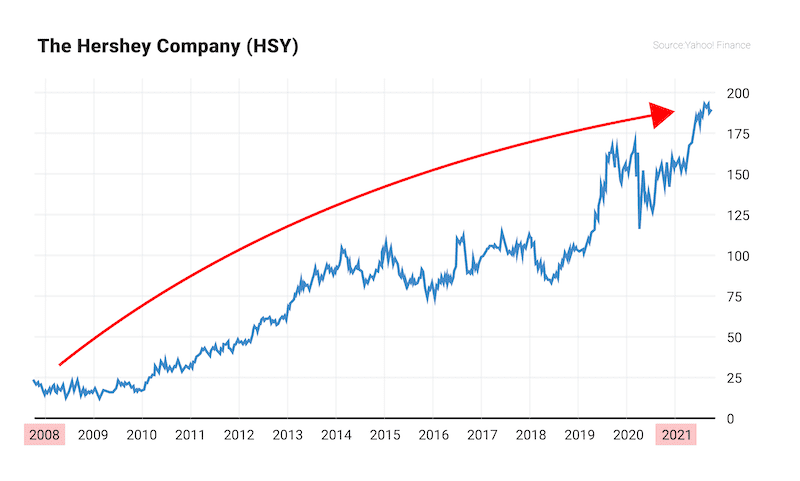

Just take a look at what happened with Hershey Inc, just after the financial crisis in 2008…

The stock shot up by more than 416%.

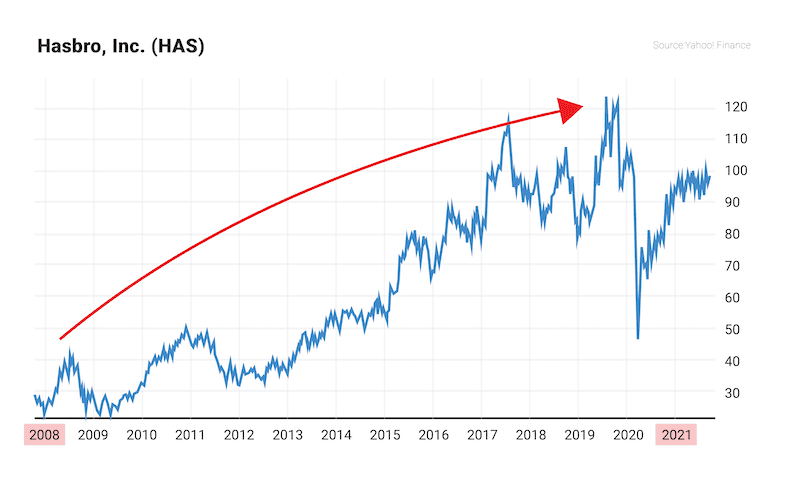

The same thing with Hasbro. Since the last recession, it’s shot up more than 345%.

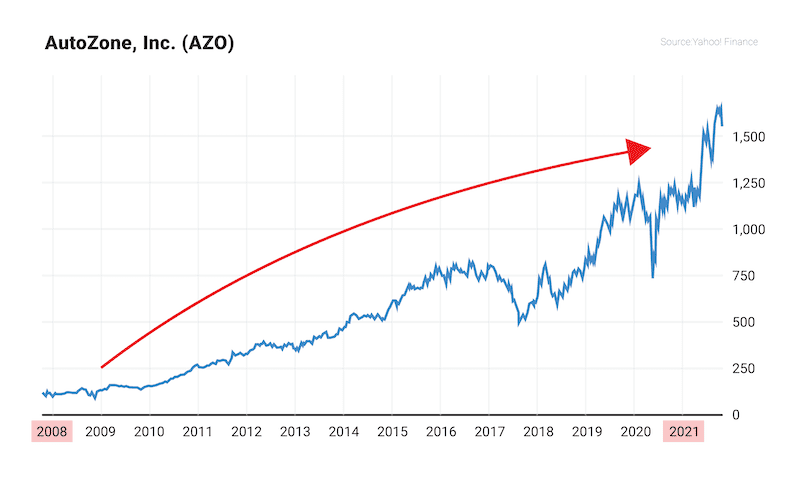

Or AutoZone, which since the 2009 recession has shot up more than 1,064%.

You see, all these companies have a secret ingredient that has them perform very well even during tough times…

They each have a high return on invested capital.

Which means that they can thrive and expand during tough times instead of withering away.

And instead of being nearly bankrupt companies, people are gambling on at the top of the bubble.

These are all very well-run companies people will flock to once the crash hits.

That' why I call them “Anti-Meme stocks”.

And I've identified 5 companies that have extremely high returns on invested capital.

All of which I believe are set to soar in the days and months ahead.

Again, in the dossier, I detail all five of them and I give you a full breakdown on each company.

DOUG: Now Jim, I’m excited to tell everybody about step #4, because again, I’ve never seen anything like it and I think it’s a tremendous opportunity for everybody on this call today. You want to go ahead and tell them?

JIM: Well, step 4 is more of a request than a step…

Step #4 Keep an Eye on Your Inbox. I’ll be Sending an Important Invitation-Only Event Ticket Your Way

You see, one of the most important assets you can have during a crisis, isn’t cash gold, or real estate…

It’s a community…

A community of like-minded people. People who share your values, who understand your worldview, while at the same time possessing skills that compliment your own.

And in today’s divisive political environment, where everybody seems to be at each other’s throats….

I know just how hard something like that can be to find.

That’s why I’m offering to invite everyone watching to a special virtual event that I’m hosting.

You see, one of the things I’m well-known for is helping the intelligence community host their first ever Economic War Games.

This was where we stress tested the U.S. financial system against threat from other countries.

And it was there that I discovered some of the secrets I still use to this day to help show a small group of people how to profit from massive geo-political events.

These are strategies that I’ve never seen before anywhere else.

And they are strategies that could help you collect sizeable profits as this crisis unfolds.

Now typically this event is kept behind a $2,000 paywall.

But today, I’m going to offer everyone that wants to claim one, a free ticket to the event…

Because not only will I be revealing some of my best strategies for profiting during a time of crisis…

But I’m going to make an important announcement regarding this crash thesis.

That’s why everyone today that wants to claim one will get a free ticket to the event.

DOUG: Now Jim, that’s an incredible gift, and I’m sure everyone watching wants to know what they need to do to claim it and keep in touch with you as this crisis unfolds.

JIM: I know that handing you this information and wishing you the best of luck just isn’t enough.

That’s why, today I’m opening up membership to my research service Strategic Intelligence through this special offer and inviting everyone on this call to join with a risk-free trial subscription.

And when you do, you’ll get everything we talked about today at no additional charge.

My mission with this research service is simple:

To help you profit from and avoid some of the most “unthinkable” events and financial crises I see on the horizon.

You see, over the course of my more than 40-year long career working at the highest levels of the finance and intelligence communities…

I’ve developed a vast network of connections and market insights that have allowed me to stay one step ahead of some of the biggest economic events of our time.

I’ve actually been inside the secure meeting rooms called vaults inside of the Pentagon.

I’ve personally helped the CIA host their economic wargames.

I’ve been in the CIA Directors’ secure conference room on the seventh floor of Langley headquarters.

I’ve been inside the West Wing of the White House.

I’ve been inside the U.S. treasury and talked to Tim Geithner.

I’ve been inside the boardroom at the Federal Reserve and I’ve personally had conversations with Ben Bernanke.

I was the man that Reagan administration turned to help negotiate the end of the Iranian crisis, and the man who the Nixon administration turned to help craft the Petrodollar Accord.

I don’t mean to brag.

But I believe it’s safe to say that when it comes to helping you protect your wealth and telling you what’s really going on behind the scenes in America today…

No one has connections or credentials quite like mine.

And in my flagship newsletter Strategic Intelligence, I share all the market insight I’ve gathered with you…

DOUG: Now Jim to be clear, this is NOT a widely publicized newsletter…

In fact, today’s call is one of the VERY few places you’ll be able to reserve your membership.

And your newsletter is the only place where you plan to continue to update everyone on this crisis.

JIM: That’s right.

And once you’re in, in addition to everything we are giving away today, you’ll also get immediate access to all of the current membership benefits.

That includes things like:

- A private access link that allows you to join an exclusive live intelligence session with me once a month.

This is where you’ll be able to get on a call with me and a small group of other members as I give you my analysis and update you on exactly what’s happening in the markets.

There will be a moderator and you’ll even be able to submit questions for me to answer.

Now remember I can’t give out any personalized investment advice, but this is as close as you’ll come to get your own personal briefing from the contacts I have in the intelligence community.

On top of that monthly intelligence briefing, you’ll also get invitations to all of our live events when the opportunity arises…

Where you can hear from and shake hands with some of the biggest names in finance and investing.

People like Robert Kiyosaki, George Gilder, Ray Kurzweil, James Altucher, and more…

These events are typically hosted in high profile locations. Like the one we recently hosted in New York City.

Remember your first event is just around the corner.

And all this is completely free for members of Strategic Intelligence.

You’ll even get access to our private model portfolio that’s updated in real time.

You see, because they are more speculative in nature, most of the opportunities we have talked about today aren’t part of the official model portfolio of my research service and won’t be tracked.

That means that once you get access to the model portfolio, you’ll get the chance to see dozens of opportunities that my readers are already taking advantage of right now.

Opportunities we didn’t have time to cover today and that have never been made available anywhere else.

And even though I can’t give any specific investing advice based on your personal financial situation, I will include exact portfolio allocations.

So you’re never lost about what you need to be doing with your money during each stage of this crisis.

DOUG: And it appears, Jim, that membership to your services has been well worth it.

In fact, here’s what some of your past members have had to say.

JIM: Thanks Doug. I’m glad to see that my work is helping out the everyday American, rather than just benefiting the members of the intelligence community and the political elite.

Washington failed to heed my warnings in 2008, but fortunately because of my newsletter, I was able to warn my small group of readers just before the worst of the crisis hit.

Now unfortunately, it appears that millions of Americans are going to be faced with a similar choice.

They can either heed this warning and take a few simple steps to protect their family’s wealth, or they can get swept under the current once this massive tsunami hits.

But they don’t have long to decide. Because once this crash hits it’ll already be too late.

DOUG: So just to recap everything that our viewers will get today.

- “The Market Crash” Survival Dossier — How to Survive and Prosper Decades That Lie Ahead” – Jim’s Intelligence Dossier that breaks down the full extent of this crisis, along with a timeline and exact step by step instructions you need to take to prepare for what lies ahead. It’s in this dossier that you’ll find all of Jim’s most important resources for the crash. Including the two reports listed below:

- How to 10X Your Money During a Market Crash – Jim’s definitive guide to buying “portfolio insurance” plays, attached with his Dossier.

- The 5 “Anti-Meme” Stocks Set to Soar Once the Bubble Bursts – 5 stocks that could skyrocket as this crisis unfolds, attached with his dossier.

- The New Case for Gold – In addition to your comprehensive dossier, Jim’s definitive guide on gold and gold investing for the coming decade.

- The New Case for Gold Hidden Chapter – This is an updated chapter of his book that includes seven of the most unique gold and silver investment opportunities that Jim has come across, including details for investing in each one.

- A FREE Goldback – Jim’s gift to everyone who takes him up on this offer today.

- One ALL-Access Ticket to the Paradigm Shift Summit – a virtual event where Jim plans to reveal a massive update about this coming crisis (valued over $2,000).

- Access to live Intelligence Briefings with Jim – Where you’ll have the chance to join Jim and a small group of people on a live call and submit general questions for Jim to answer.

- Access to the Strategic Intelligence Model Portfolio – You get recommended portfolio allocations so you’re never lost on where you need to put your money during each stage of this crisis.

Now Jim, this is an incredible value, and it’s hard to put an exact price on it.

In the past, just your dossiers alone have been used by the Pentagon, the CIA, members of congress.

Your expertise has been used by Wall street CEO’s, heads of state and even sitting U.S. Presidents.

Your speaking fee alone is over $25,000.

And you even do private consulting work for foreign governments like the government of Liechtenstein for an undisclosed fee.

So I’m sure everyone wants to know, what does it take to get started?

JIM: Our only goal today is to get this information into as many hands as possible.

That’s why, even though access to some of my mid-tier research services in the past has cost upwards of $2,000 a year.

And some of my high-end research can go for as much as $4,500.

Today we are offering a trial subscription for just $49…

Again, that's for the entire year.

In addition to that, anyone who signs up today will lock in that low rate from year to year as long as they choose to be a member of Strategic Intelligence.

DOUG: That’s a truly incredible offer. Can you explain what you mean by a “trial subscription”?

JIM: It works exactly how it sounds. If at any time during the first 6 months of service, if you don’t feel like you’re getting the best financial research available…

Simply call my team and we will give you a complete refund, no question asked.

You can even keep all of the reports, the dossier, the goldback, everything it’s all yours.

It almost seems silly when we are asking for such a small commitment in the first place.

But I don’t want ANYTHING holding someone back from protecting their family’s wealth as this crisis unfolds.

With this offer, I tried to eliminate every excuse that I think someone could have.

DOUG: Well, with the trial subscription, the guarantee, the bonuses, and the extremely discounted price, it seems like you’ve done just that.

We will open up the links now so everyone can begin to reserve their memberships below.

All you need to do is click the box below this screen and you’ll be taken to a secure order form.

Anybody that wants to sign up can go ahead and do so now.

And Jim, on behalf of everyone watching I'd like to thank you for your time.

That wraps up our event today.

And think you can see why we wanted to get Jim's message in front of all you .

After predicting so many major macroeconomic events over the last 20 years…

From the 2008 financial crisis, to Brexit, to the election of Donald Trump, and more.

Jim’s track record is second to none.

He's helped people avoid some of the biggest crises of our time.

Now with the urgency of his stark new warning looming…

You've now been given the opportunity to decide.

Are you going to be one of the victims of the next market crash?

Or are you going to be one of the people that takes action and side steps the devastation that lies ahead.

It's up to you.

Thanks for joining us.

This is Doug, signing off.

You Can Review Your Order Before it’s Final

© 2022 Paradigm Press, LLC. Legal Notices: In order to ensure that you are utilizing the provided information and products appropriately, please be sure to visit Paradigm Press Terms and Conditions and Privacy Policy pages.

Leave a Reply