In this Article

There are a million factors for investors to consider when investing in gold stocks. And among the factors considered to be most important is ore grades.

When a mining company talks about ore grades, it is usually referring to the concentration of mineral contained within the rock. For gold, grades are typically reported to the public in grams per tonne (g/t).

A gold grade of five g/t simply means there are about five grams of gold contained within every ton of rock.

Gold mining companies use grades in various ways, from determining where to explore next to feasibility. But among the most important of a gold mining company's grades are known as the “mill-head” and “recovery” ore grades.

Mill-head grade refers to the concentration of metal within ore as it goes to the mill for processing. And recovery grades measure the actual gold content of ore after processing. Both generally reflect the quality of the material processed.

As mentioned, gold grades are critical in determining the economic feasibility of mine operations. Mines with higher-grade ore tend to produce more gold at lower costs than mines with lower-grade ore.

And that’s simply because lower-grade mines have to process more material, resulting in higher costs.

For example, a mine producing gold from ore that grades two g/t needs to process 15.5 tonnes of material to produce one troy ounce.

One producing gold from ore that grades four g/t, on the other hand, needs to process half that (7.7 tonnes) to produce the same one-troy ounce of metal.

According to the World Gold Council, most of the world’s gold mines operate with grades in the one g/t to four g/t range. These are generally considered to be low-grade mines.

A high-grade mine is typically one that operates with recovery grades between eight g/t and 10 g/t.

High-grade gold mines are relatively rare. But there are a handful of commercial mines in the world that operate over 10 g/t. These are typically very small mines that are part of a much larger complex. Nevertheless, here are the highest-grade gold mines in the world…

(Note: This list is limited to commercial operations owned by publicly traded companies. There are no doubt several other small +10 g/t Au-grade mines around the world that are not included here.)

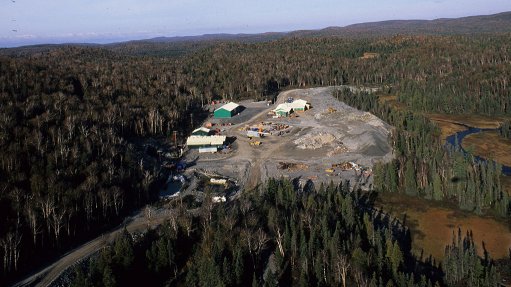

The first high-grade gold mine on our list is located in Ontario, Canada. The Island Gold Mine is owned and operated by Canadian miner Alamos Gold (NYSE: AGI).

Island Gold Mine

In the first quarter of 2022, the Island Gold Mine produced 24,500 ounces of gold with underground mining rates averaging 8.35 g/t. Alamos’ recovery grade at Island Gold, however, was much higher just a few months ago. During the same quarter of 2021, the underground grade at Island Gold Mine was 13.29 g/t.

For 2022, Alamos expects Island Gold to produce between 125,000 and 135,000 ounces of gold at a total cash cost ranging between USD$550 and USD$600 an ounce.

To find the next mine on our list, we don’t go far. Wesdome Gold's (TSX: WDO) Eagle River Underground Mine is also located in Ontario.

Eagle River Mine

The Eagle River complex has been producing gold for more than 25 years now. In the first quarter of 2022, the Eagle River Underground Mine produced 19,334 ounces of gold for Wesdome at an average head grade of 11.6 g/t. This was below the company’s guidance of between 12.1 g/t and 13.4 g/t.

Despite very high grades found at Eagle River, production there is relatively expensive. During 1Q 2022 cash cost at Eagle River was USD$997 per ounce sold. This was a 10% increase for Wesdome compared to 1Q 2021.

The next mine on our list… also in Ontario.

[The Royalty of Gold: Earn 10x Your Money on the Roaring Gold Bull]

Agnico Eagle Mines’ (NYSE: AEM) Macassa Mine is the highest-grade commercial gold mine in the Western hemisphere.

Macassa Mine

The mine produced 43,943 ounces of gold during the first quarter of 2022 with an impressive average head grade of 16.64 g/t and cash operating cost of USD$790 per ounce sold.

Up next we get to the highest-grade commercial gold mine in the world.

And it’s not in Ontario.

But it is also owned by Agnico Eagle.

The highest-grade gold mine in the world is Agnico Eagle’s Fosterville Mine in Victoria, Australia. And when it comes to high-grade gold mines, Fosterville sets the standard.

During the first quarter of 2022, the Fosterville mine produced 126,707 ounces of gold with an incredible average head grade of 28.13 g/t and total cash costs per ounce of just USD$309. Below we see the shaft entrance to the Fosterville Mine. This is one of the most valuable holes in the world.

Fosterville Mine Entrance

And Fosterville’s average head grade has dropped significantly since the pandemic. Prior to COVID, Fosterville’s average head grade was over 40 g/t.

It's important to note that all of these mines are active operations. There are several projects around the world that have the potential to become the next super-grade gold mine.

Until next time,

Luke Burgess

[The Royalty of Gold: Earn 10x Your Money on the Roaring Gold Bull]

Leave a Reply