In this Article:

- Global X Silver Miners ETF (NYSE: SIL)

- Wheaton Precious Metals (NYSE: WPM)

- Pan American Silver (NASDAQ: PAAS)

As a writer, you don’t always get to write exactly what you want.

Of course you can’t write everything on your mind, just like you can’t say everything on your mind out loud, but writers are often compelled in some way (either with the carrot or the stick) to write something they wouldn’t have come up with by themselves.

That was the case in 1950 when American composers Jay Livingston and Ray Evans were compelled by Paramount Pictures to write a Christmas song for the studio’s latest comedy film The Lemon Drop Kid.

By the way, your guess as to what this movie is about is as good as mine. According to the plot summary, it's about a small-time conman who ends up owing $10,000 to a gangster and has to come up with the money before Christmas, which leads to him doubling down on the scams. But I don't know — that poster doesn't convey that plot to me.

Anyway, according to the 2006 book America's Songs: The Stories Behind the Songs of Broadway, Hollywood, and Tin Pan Alley by Philip Furia and Michael Lasser, the songwriters did not want to compose a Christmas song, saying, “It’s impossible to write a Christmas song. Every year everybody sings the same old Christmas songs, and new ones never make it.”

But Paramount pushed, and the composers eventually found inspiration in a small silver bell that Ray Evans kept on his desk.

The song Livingston and Evans would end up writing was, of course, “Silver Bells,” most famously performed by Bing Crosby and Carol Richards.

It’s hard to say exactly when “Silver Bells” became a Christmas classic, but it’s absolutely a song you can’t avoid in December.

And I’m sure both Jay Livingston and Ray Evans (who both lived into the 2000s) were very glad to be wrong about it being impossible to write a Christmas song.

In a bit of a humorous twist, Livingston and Evans originally titled the song “Tinkle Bells,” referring to the sound tiny bells make. But when Livingston told his wife about the song, she reminded him of the double meaning, and the two promptly changed the title to “Silver Bells.” Good move, I’d say. “Piss Bells” may not have been the Christmas classic Paramount was hoping for.

Either way, like I mentioned, “Silver Bells” is a song you can’t avoid in December. I’ve already heard it a few times and it made me think of silver stocks.

In the past several months, we’ve talked a lot about gold and gold stocks, but it has been quite a while since we looked at silver stocks. And with gold finally on the upswing after months of being under pressure from a rising dollar, I thought it was a good time to tell you about three of my favorite silver stocks.

Three Silver Stocks for Christmas

The first I want to point out is really a basket of silver stocks.

Global X Silver Miners ETF (NYSE: SIL) — One Year

SIL’s performance generally corresponds to the Solactive Global Silver Miners Total Return Index, which tracks a number of major silver-producing and royalty companies. The ETF’s most prominent position, holding 23.52% of its net asset, is Wheaton Precious Metals (NYSE: WPM), which we’ll talk about next. Other important holdings include Korea Zinc Company Ltd. (9.40% net asset) and Pan American Silver (8.53% net asset), which we’ll also talk about.

Of course, as with any ETF, expenses and fees are going to affect your overall earnings. SIL has an expense ratio of 0.65%, which isn’t bad among ETFs, but it’s something to consider. Nevertheless, if you were looking for a safe, easy way to get short-term leverage on rising silver prices, SIL is a great option.

[Exclusive: Biden To Introduce “Biden Bucks”?]

If you want to avoid those expenses and fees and still be on the safe side, I think Wheaton Precious Metals by itself is a great play.

Wheaton Precious Metals (NYSE: WPM) — One Year

Wheaton isn’t a traditional mining company but rather a precious metals (mostly silver) streaming company. Wheaton makes deals to buy silver and other metals from mining companies for an upfront payment.

It basically helps finance mining operations in exchange for a good price on silver and other precious minerals. Doing this provides the company leverage on high-quality assets with predictable costs.

Right now, Wheaton has streaming agreements with companies operating 21 mines. The company says 90% of the operating mines are high-margin operations working in the lowest half of their cost curve.

Meanwhile, Wheaton has deals with companies actively developing 13 large-scale mineral projects, so the company and its investors have exposure to both a low-risk revenue stream and the upside of exploration and expansion.

Wheaton even pays a little dividend. Right now, WPM pays $0.15 per share per quarter. At the current share price, that’s an annual 1.54% dividend. Again, that’s not much, but it’s infinitely larger than the annual 0.65% expense SIL would cost you.

I like WPM as a longer-term play for any investor.

The last stock I want to direct your attention to is Pan American Silver (NASDAQ: PAAS).

[Alert: Biden issues Executive Order #14067]

Pan American Silver (NASDAQ: PAAS) — One Year

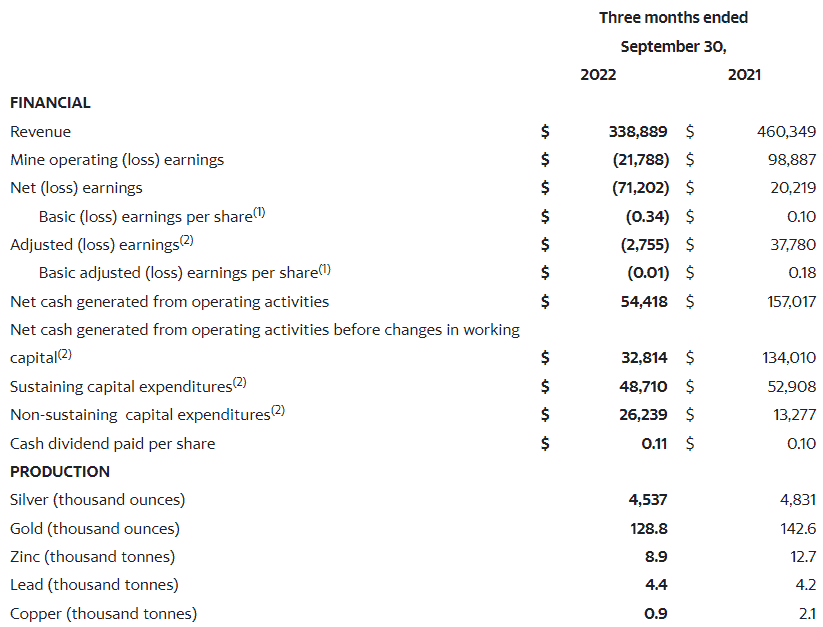

Pan American is a traditional precious metal mining company with a 28-year history of operating in Latin America. Today, the company mines more than 19 million ounces of silver per year (as well as other precious minerals) from operations in Mexico, Peru, Argentina, Bolivia, and Canada. Pan American’s most recent financial statement shows a significant decline in revenue, earnings, production, and pretty much everything else across the board.

Pan American Silver Q3 2022 Financial Summary

That has left PAAS with one of the lowest P/E ratios among the silver miners.

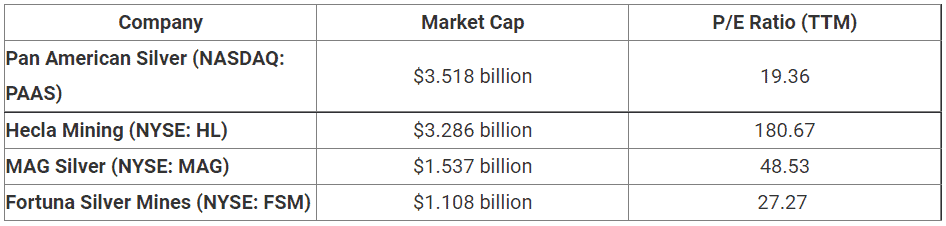

Right now, PAAS has a P/E ratio of 19.36. Compare that with some of Pan American’s competitors:

With declining quarterly revenue, earnings, production, etc., PAAS is more of a risk than either SIL or WPM. However, the big upside to Pan American Silver is its name — and believe me, the company’s name brand is very important.

Pan American Silver is a very well-known name among silver miners. It’s one of the first companies people think about when they think of silver mining. That means it’s also one of the first companies investors are going to think of when they see silver prices rising. And with a relatively low P/E, PAAS is a silver miner they’re going to want to own.

That's all I've got for you this week.

Sorry if you never hear “Silver Bells” the same way again.

Until next time,

Luke Burgess

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Leave a Reply