In this Article

- When the Fed raises rates, gold prices rise…

- Gold shot from $402 per ounce to $584…

- Gold has been a pretty reliable investment for the past 25 years

Here’s a fun fact about me…

I’m a real history buff.

I love history. Always have. Always will.

I’ve read thousand-page books on the Ottoman Empire. I’ve spent way more time than I should have researching World War I. And just last week, my father-in-law walked in on me watching a PBS special about the ancient civilizations of Mesopotamia.

There are more embarrassing things for a person to admit, but here today, I’m telling you I’m a nerd.

It’s not surprising, then, that a lot of my theories and predictions regarding the markets are based on historical precedent.

And one of those theories has to do with gold.

I’ve even mentioned it right here in Outsider Club on numerous occasions. And each time, it proved prophetic.

So prophetic, in fact, that had an investor followed my advice, they would have made a substantial amount of money in a relatively short period of time.

It has to do with the price of gold, as it relates to monetary policy, and the biggest myth that investors mistakenly believe about the yellow metal.

Here it goes…

The biggest misconception about gold is that it loses value in periods of monetary tightening.

The conventional belief is that the Fed raises rates, the dollar strengthens, inflation disappears, and gold tumbles.

Well, that’s simply not true. I’m not going to get into the dollar/inflation business, because I want to keep this simple.

It’s not important anyway.

[Alert: 3rd Massive Dollar Upheaval Has Started – “Retiring” the US Dollar?]

The main takeaway is that when the Fed raises rates, gold prices rise.

And if anyone doubts that, I’ll simply point them to the historical data — namely the past three monetary tightening cycles.

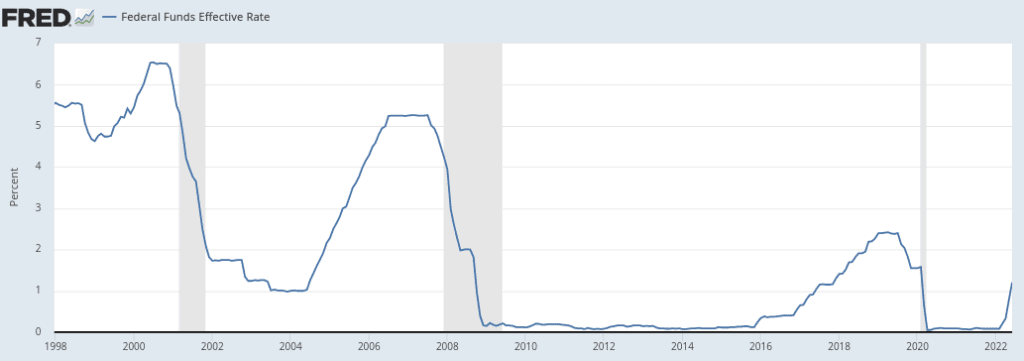

These took place from 1999–2000, 2004–06, and 2015–19.

Here they are in a chart:

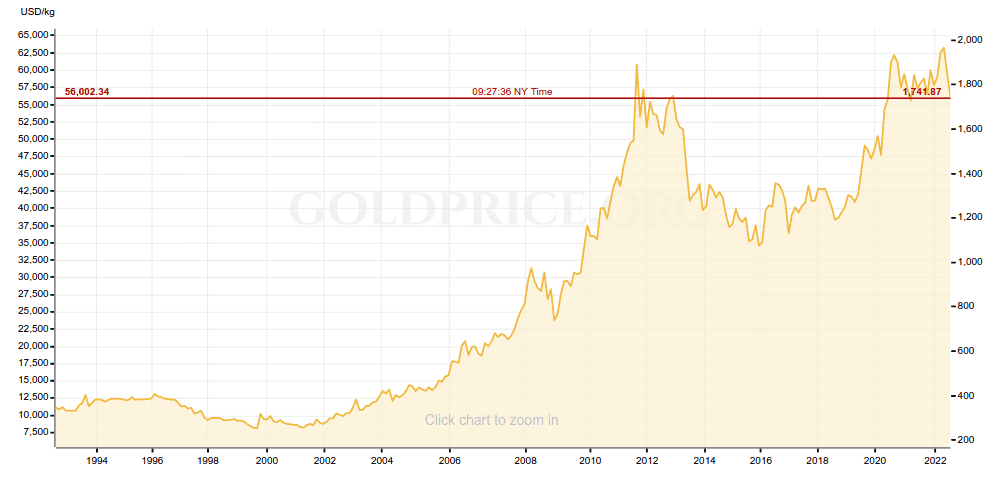

Now we’re going to compare that with gold prices over roughly the same period.

Here are those:

Now, in the first case, you can see interest rates surged from 4.6% in January 1999 to 6.5% in August 2000. And then if you look at that time frame on gold's chart, you can see a small blip right around that time during which gold prices popped from $286 per ounce in January 1999 to $308 in early 2000.

That’s a 7.7% increase, which is nothing to write home about but notable.

[Biden Bucks: Executive Order 14067 could pave the way for a social credit system just like China]

Moving on, though, we see the period from June 2004 to June 2006, in which interest rates climbed at a relatively steady pace from 1.25% to 6.25%.

And in that period, the price of gold shot from $402 per ounce to $584 — a 45% increase.

Then, finally, we have the third period, which ran from December 2015 to December 2018, in which the Fed methodically ratcheted rates up from 0–0.25% to 3%.

And in that period, gold prices rose 16%, from $1,076 per ounce to $1,250 per ounce.

This was around the same time that I told Outsider Club readers about my theory of historical precedent.

That was September 2017 — at which point gold was trading around $1,300 per ounce. And if readers took my advice, they would have profited not just from the surge to $1,500 that I called for, but also the massive spike to more than $1,900 in 2020 and to more than $2,000 earlier this year.

In fact, I reiterated my gold call in March 2020, when it was still below $1,500 per ounce, fully predicting it’d hit $2,000 in the wake of the pandemic.

All of this is to say that gold has been a pretty reliable investment for the past 25 years — if investors were savvy enough to time it right.

And I think right now is actually a good time to buy, since the price has dropped from a high of $2,052 in March to less than $1,750 today.

A lot of that decline has to do with the Fed raising interest rates, but as we just learned, gold has a counterintuitive habit of rising in these circumstances.

It could be the disruption higher interest rates cause to the economy and stocks that sends investors fleeing for safe havens. Or it could be that rising interest rates simply don’t bolster the dollar the way many people anticipate. Maybe a mixture of both.

But regardless of the reason, history is clear on this one point: It’s a good time to buy gold.

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Fight on,

Jason Simpkin

Leave a Reply